FINANCIAL MANAGEMENT

At CAKI, we have designed a WIKI around financial management. You will find the WIKI at the bottom of the page. Gain insight into core concepts and other relevant basic knowledge regarding economics through CAKI’s economics WIKI. We hope the WIKI can better equip you and other startups to begin financial management of your businesses.

In addition, we have uploaded links to other places where you can get knowledge about how to book, make accounts, find your way in tax and VAT, etc. These can be found at the bottom of the boxes to the right.

A-Income & A-Tax

A-Income is a tax term for the main type of your income, on which you pay the so-called A-tax.

A-Income is reported annually to SKAT (Danish Tax Authority), so it can be reflected in the preliminary income statement and the annual statement.

A-Tax is the tax paid continuously by having the employer or another withholding agent report the A-income to SKAT.

A-Tax is the tax paid on the primary income.

When, for example, wages are paid out, a preliminary tax is withheld. This is what is referred to as A-tax.

Accounting

An account is an overview of the financial activities that have taken place in a company or a project. It is a report that describes how the company has performed in a defined and concluded period. In your business, you should always prepare an annual account when providing information to the tax authorities. It may also be a good idea to create a semi-annual or quarterly account for your business. The account is prepared based on bookkeeping.

Legal Requirements

If you have a business, the annual account shows all the financial activities the company has had throughout the year.

Here are some key components of an account:

- Income Statement: Shows revenues and expenses during the accounting period. It often includes items such as sales revenue, costs of goods or services, wages, taxes, and profit or loss.

- Balance Sheet: Shows the organization’s financial position at a given point in time. It includes assets (what the organization owns), liabilities (what the organization owes), and equity (the difference between assets and liabilities).

- Cash Flow Statement: This statement shows the incoming and outgoing cash during the accounting period. It helps assess the organization’s liquidity and ability to pay bills and debts.

- Notes to the Account: These are supplementary details providing additional information about the account, including accounting principles, applied estimates, and other important information.

Uses of Accounts

Accounts serve various purposes, including:

- Internal Decision Making: Organizations use accounts to evaluate their financial performance, plan budgets, and make strategic decisions.

- External Reporting: Accounts are provided to stakeholders such as investors, creditors, and tax authorities to demonstrate the financial health of the organization and compliance with rules and regulations.

- Tax Liability: Accounts form the basis for calculating taxes and fees.

Types of Accounts

There are several types of accounts:

- Internal Accounts: Periodic Accounts and Annual Accounts.

- External Accounts: Quarterly Accounts, Semi-Annual Accounts, and Annual Accounts.

- Tax Accounts

- VAT Accounts

Accounting system

This allows you to stay up to date on your company’s or project’s finances.

By having fixed routines, you also make sure that things get done. Many people have a tendency to postpone bookkeeping, VAT accounting, etc. until the last minute. This is a bad idea for several reasons that you are probably already aware of. You should therefore make sure to regularly update your accounts based on your bookkeeping – ideally once a month.

The accounting system you use specifies your practices for issuing invoices, posting expenses, settling VAT, preparing annual reports, etc.

The accounting system can be one you have made yourself and which you regularly update and maintain or one you have paid for. For example, you can subscribe to an online accounting programme that you use yourself or hire an accountant who does the work for you.

Your accounting system should be compatible with the activities in your business or your project and meet your specific needs. That is why it could also be anything from an Excel sheet to an accounting system you have purchased or subscribed to.

When choosing an accounting system, it, therefore, makes sense to try out a few different solutions and experience the different ways with which to deal with financial management. This will allow you to decide what works best for you.

AM-bidrag

Employment Contribution

Regardless of the figures on your preliminary income statement, you must always pay 8% in employment contribution (AM-bidrag) on your salary or profits from self-employment (but not on student grants, unemployment benefits, and pensions).

If you own a personally owned business (PMV, sole proprietorship, and I/S), the employment contribution is automatically included through your B-tax rates, calculated based on your preliminary income statement.

Artist VAT

Some students in artistic programmes need to register their company with a CVR number (CRN). You may therefore encounter students who need information about the VAT rules that apply for the type of artistic enterprise they have. The rules for VAT registration and payroll taxes are part of what one needs to be aware of when registering a company.

Read more about VAT, artist VAT and payroll taxes in CAKI’s Mini-guide here.

Assets

Assets are the company’s holdings.

Assets make up everything of value the company owns. For example, this includes cash, materials, inventories and receivables.

An asset overview accordingly shows where the company has placed its money. An accountant will refer to this as the company’s investments.

Assets are divided into fixed and current assets.

Current assets

Current assets are assets that a company expects to have realised, resold or consumed within one year.

Fixed assets

Fixed assets are assets that are current for a long time in a company; they make up what has been invested in the company.

Often, these are divided into tangible, intangible and financial assets. These distinctions are made because there are differences in how they should be made up and factored into the financial statement.

Tangible fixed assets

Tangible fixed assets could include machinery (computer, copier, sewing machine…) or buildings.

Intangible fixed assets

Intangible fixed assets are non-physical and non-financial assets obtained for use in the company. Examples of such assets include goodwill, trademarks, patents, etc.

Financial fixed assets

The third form of fixed assets is financial. Financial fixed assets can be the various types of securities, equity investments and loan types to subsidiaries – generally monetary assets.

Financial fixed assets generally have a maturity of at least one year.

Fixed assets and bookkeeping

Your fixed asset should be entered under the assets in the balance sheet with the full amount. You then write off the asset in the balance sheet and income statement, either monthly or annually, until the asset has been completely written off. This ensures that the value is distributed over a period and constantly updated.

Financial assets are not usually subject to ordinary depreciation rules, as the value of the financial investment does not necessarily decrease over time.

ATP - Labour Market Supplementary Pension

ATP (Arbejdsmarkedets Tillægspension) is a mandatory pension scheme in Denmark for everyone over 16 years old who works more than 9 hours per week.

It is part of the Danish social security system and is administered by ATP, which is an independent institution.

ATP is designed to provide financial support to Danish citizens when they retire or, in certain cases, in the event of disability or death.

Balance

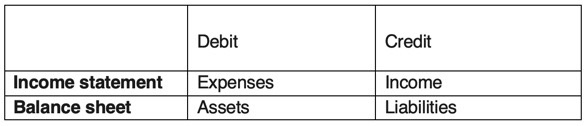

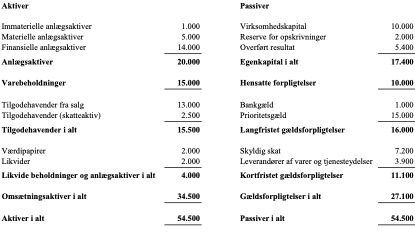

Combined, assets and liabilities result in a balance (assets minus liabilities). A balance is therefore a calculation of the company’s assets and liabilities at a given point in time. It is also what is stated on the form describing debit and credit:

The balance shows the company’s:

- Assets

- Liabilities

- Equity

The valuation of the company’s assets can to a great extent be subject to estimates, and the balance sheet sum will depend on the chosen valuation of the assets.

B-income and B-tax

B-Income is income where tax and employment contribution (AM-bidrag) have not been deducted before you receive the amount. For example, if you are a freelancer or have received a fee for giving a concert or presentation.

You are responsible for paying tax and AM-bidrag on your B-Income.

B-Tax

You pay B-tax by using invoices issued by SKAT (Danish Tax Authority) along with the preliminary income statement.

B-tax is usually paid in up to 10 installments during the income year.

These installments are calculated based on the preliminary income statement.

You can also report B-Income on an ongoing basis.

Budget

A budget is a financial plan created to provide an overview of income and expenses for a specific period, typically for a month, quarter, or year.

Elsewhere on this page, you can download various budget templates.

Capital Yield Scheme

The Capital Yield Scheme (Kapitalafkastordningen or KAO) is a voluntary tax scheme for personally owned businesses. It serves as an alternative to personal income tax and the Business Tax Scheme (Virksomhedsskatteordningen or VSO).

If you opt for this scheme, you need to calculate the capital yield from the business’s assets, which can be deducted from your personal income and transferred to capital income. This process involves first determining the value of your business assets.

At the beginning of the income year, you must find the annual rate for capital yield to calculate the capital yield basis. Finally, this amount is deducted from your personal income and added to capital income.

With this scheme, you can also deduct the business’s interest expenses from your personal income.

Read more about the scheme here.

Chart of accounts

The starting point for double-entry bookkeeping is that financial transactions are divided according to their nature into a number of categories, each of which is entered into an account. This means that you enter income and expenses across a number of accounts systematised according to the type of income or expense the account represents in the company (read more about entries in ‘Double-entry bookkeeping’ and ‘Debit and credit’.

In order to create a system and overview of your accounts, you create a chart of accounts. You choose yourself what numbers your accounts should be identified as, but for simplicity’s sake, you should choose a simple and consecutive order. There is no requirement to set up a specific number of accounts. This depends on the concrete situation and each individual business.

All your bookkeeping accounts will collectively constitute what is called a chart of accounts.

All accounts in your chart of accounts fall under one of the five main accounting groups:

Expenses: Consumption for the current year

Income: Income for the current year

Assets: Money, receivables, inventories, machinery, buildings, etc. at your disposal.

Liabilities: Debt owed to borrowers and owners (equity)

Equity: The value of the part of the company’s assets that are not financed by borrowed capital

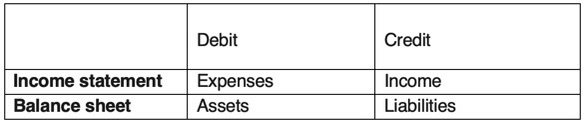

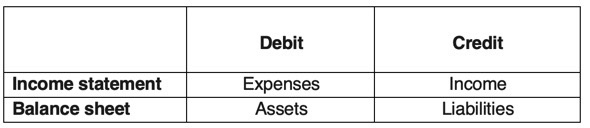

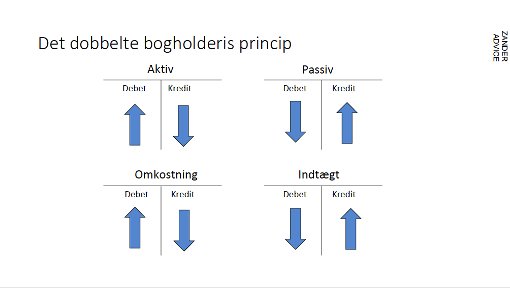

Each account is divided into a debit and credit side, which are kept as follows:

Inflows to an asset or expense account are posted on the debit side, while outflows are posted on the credit side.

Inflows to a liability or income account are posted on the credit side, while outflows are posted on the debit side.

The balance on an account is found by summing up all the debit entries and credit entries, respectively, and deducting the smallest sum from the largest. The balance is the resulting remainder.

You can download an example of a chart of accounts from the Download box on this page.

Debit and credit

In order to use debit and credit correctly, you need to know which accounts are debit accounts and which are credit accounts.

You can see that here:

Debit is used when money goes into a debit account.

If you remove money from a debit account, the money needs to be credited from a debit account.

Credit is used for a credit account that receives money.

If you are taking money out of a credit account, you would therefore debit the amount.

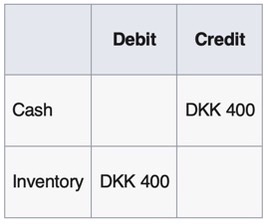

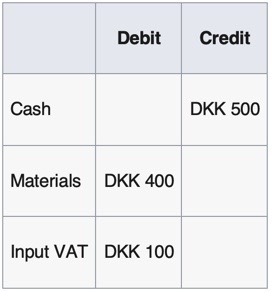

Examples of debit and credit in bookkeeping

You buy paint for DKK 400, and you pay for it with money from your business account.

You now have to enter a sum on two accounts: ‘Cash’ and ‘Inventory’.

‘Cash’ represents the company’s cash reserves. It is therefore an asset, making it a debit account.

If you have to decrease the balance of the account as in this case, where you are taking money out of the account, you, therefore, need to credit (see the above table).

‘Inventory’ is also an asset account, as the materials constitute an asset in the company. As a purchase of materials results in a value increase in the company’s inventory, the account ‘Inventory’ should therefore be debited.

If VAT needs to be included, things look a bit differently.

When including VAT in the entries, the bookkeeping looks as follows:

DKK 500 has been taken out of the cash account (credit). The money has been entered as an expense on the account ‘Materials’ (DKK 400 debit), and the VAT amount has been posted as a receivable on the account ‘Input VAT’ (DKK 100 debit).

Alle dine bogføringskonti samlet vil være det, man kalder for en kontoplan.

Alle konti i din kontoplan hører til en af de fem hovedgrupper i regnskabet:

Omkostninger: Indeværende års forbrug

Indtægter: Indeværende års indtægter

Aktiver: Penge, tilgodehavender, lagre, maskiner, bygninger m.v. som du har rådighed over.

Passiver: Gæld til fremmede og til ejere (egenkapitalen)

Egenkapital: Værdien af den del af firmaets aktiver, som ikke er finansieret af fremmedkapital

Hver konto er delt i en debet- og en kreditside, der føres således:

Tilgang til aktiv- eller udgiftskonti posteres i debetsiden, mens afgang føres i kreditsiden.

Tilgang til passiv- eller indtægtskonti posteres i kreditsiden, mens afgang føres i debetsiden.

Saldoen på en konto finder man ved at summere alle posteringerne i henholdsvis debet og kredit og trække den mindste sum fra den største. Saldoen er den herved fremkomne rest.

Du kan downloade eksempel på en kontoplan i download-boksen her på siden.

Depreciations

The asset needs to be depreciated in accordance with the lifespan of the asset. For example, a PC will have a shorter lifespan than a car and will therefore depreciate faster.

Three ways to depreciate: linear, digressive and progressive

- Linear depreciation is the most commonly used method and entails writing off equal parts of the value over a number of years

- Digressive means that the depreciation declines over time

- Progressive means that the depreciation increases over time

The reason why assets have to be depreciated is that the real value of the assets will thereby fit with what has been factored into the accounts, giving an accurate picture of the company’s value as a whole.

Usually, intangible assets have a long depreciation period. However, one can end up in a situation – such as during the Great Financial Crisis – where a company’s goodwill disappears and is accordingly depreciated to zero.

Intangible fixed assets are non-physical and non-financial assets obtained for use in the company. Examples of such assets include goodwill, trademarks, patents, etc.

Double-entry bookkeeping

The double-entry bookkeeping system thereby entails that every financial transaction results in at least two entries in the accounts – a debit entry and a credit entry.

If, for example, you purchase an item in cash and add it to your company’s inventory, you would have to record a debit to inventory (an asset account) and record a credit to cash (an asset account).

It is not important in this context whether the debit and credit amounts are divided over an equal number of accounts. What matters is that when examining the accounts as a whole, the sum of balances for all credit columns must equal the sum of balances for all debit columns.

Regardless of how many transactions have been posted, the value of your debit and credit balances should be equal. This is the key to the ‘magic’ of double-entry bookkeeping: that the sum of all debit columns produces the same result as the sum of all credit columns. If this is not the case, there has been a bookkeeping error.

Double-entry bookkeeping thereby has a built-in control mechanism in the sense that the sum of all debit balances should correspond to the sum of all credit balances. If this is not the case, there has been a bookkeeping error. In other words, the system has a built-in control mechanism.

Model: Marianne Zander Svenningsen, Zander Advice

Trivia from Wiki:

Double-entry bookkeeping is a method that stems from Italy, where it was developed by merchants and bankers.

The oldest description of the double-entry bookkeeping method is found in a book written by the Italian Franciscan friar Luca Pacioli in 1494. The book is entitled Summa de arithmetica, geometrica, proportioni et proportionalita.

Pacioli describes double-entry bookkeeping as a method that is already known, and examples have also been found of bookkeeping following the double-entry bookkeeping method dating as far back as the early 13th century.

Pacioli’s book reviews how to efficiently perform calculations with the new numerals – Arabic numerals, which at the time were being introduced in Europe. Because a lot of calculation is associated with bookkeeping, he found it appropriate to also include a meticulous description of the double-entry bookkeeping method, which at the time was so thoroughly tested that only minor changes have been made to the method since then.

Equity

Equity represents the value of the company.

Equity is essentially the result of subtracting the sum of the company’s assets from the sum of its liabilities. Liabilities are made up of provisions and debt.

Equity consists of different parts that are made up each year in connection with the preparation of the annual report. A so-called equity statement is prepared in connection with the report.

The equity that is part of the balance sheet is increased with the portion of the year’s profit that is not paid out to shareholders. Similarly, the company’s equity will decline if the company ends up with a loss for the financial year.

The profit statement, therefore, provides an overview of income and expenses over the course of the fiscal year, while the balance sheet provides an overview of the company’s overall value throughout the years at a given time (year-end date).

Financial statements

A company’s financial statements are comprehensive reports containing information about its financial activities and position during a specific period, usually a fiscal year.

The purpose of these statements is to provide stakeholders like yourself, tax authorities, investors, creditors, shareholders, and management with insights into the company’s financial health and performance.

There are two main types of financial statements:

-

Annual Financial Statements: These encompass various sections, including the income statement, balance sheet, and cash flow statement. They detail the company’s revenues, expenses, assets, liabilities, and cash flows during the fiscal year. These statements are used for external reporting to investors and regulatory bodies.

-

Internal Financial Statements: These are used by a company’s internal management for decision-making, planning, and monitoring the company’s performance. They might include budgets, cost calculations, cost centers, and other internal reports that aid in managing the day-to-day operations of the business.

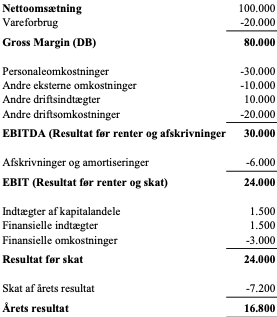

Income statement

An income statement is a calculation of a company’s result over a period, i.e. earnings within a delimited period.

Income and expenses make up the result of the operating accounts (income minus expenses) for the current period. You can also see this in the form describing debit and credit:

The income statement shows the company’s:

- Income

- Expenses

- Profit/loss

How you set up the income statement and what designations you use will be determined by the type of activities you have in your business.

EXAMPLE:

Invoice - rules for

Invoice Rules

It is a requirement that all invoices must include the following:

Invoice Number:

Every invoice must have a specific and individual number.

Sequential numbering should be used, meaning the next invoice should have the number 100 if the latest one was number 99.

There is no requirement for the number your first invoice should have, so you are allowed to start, for example, at number 1000.

In addition, an invoice must contain the following:

- Invoice Date

- Seller Information: VAT number, Company name and address

- Buyer Information: Company name and address

- Details of the Sale: Goods/services, quantity, price

- Delivery Date

- Total Amount Including VAT, VAT Rate, and VAT Amount

- Currency

Insurances

A preliminary income statement is a calculation of your income for the upcoming year and what you have to pay in taxes.

The preliminary income statement is, therefore, a kind of budget for the year. It looks ahead and shows your expected income, deductions, and taxes for the year.

You should continuously update the preliminary income statement if your finances or life circumstances change. This way, you pay the correct tax as you go, get the right deductions, and can avoid additional taxes in connection with the annual statement.

Your tax rate and monthly deduction are automatically calculated when you change your income in the preliminary income statement. Then, the Danish Tax Agency (Skat) generates a new tax card for you, and it is automatically sent to your employer or other payers.

When you receive fees under your CPR number:

- You pay ongoing tax on your B-income by providing your expected profit or loss on the preliminary income statement.

- You can update your preliminary income statement and report B-fees continuously.

If the additional tax you have to pay is less than DKK 21,798 (including interest), you don’t have to pay it immediately.

If you haven’t paid by July 1, 2023, the additional tax (including interest) will be included in your tax for 2024. This means your monthly deduction will be reduced, and you will pay a bit more in tax over the year.

This incurs some interest. After July 1, 2023, you cannot voluntarily pay what you owe in tax for 2022. Instead of interest, a fixed surcharge of 3.8 percent is added to what you owe in tax.

However, if your additional tax is over DKK 21,798 (including interest), it is collected in three installments in August, September, and October 2023, if you haven’t paid it yourself by July 1, 2023.

Liabilities

Liabilities show the company’s raised capital, i.e. how the company is financed.

A company’s liabilities thereby allow you to understand everything that’s financing the assets, including equity, overdrafts, trade creditors and long-term loans.

Liabilities are divided into equity, provisions and debt.

Equity is the result of the difference between the value of the company’s assets on the one hand and the company’s debt and provisions on the other.

The overall debt includes debt, provisions and contingent liabilities.

A contingent liability is one of several expenses that have not yet been incurred and are not already factored into the accounts. In other words, a contingent liability is not yet an obligation for the company, and it is therefore uncertain whether it is something the company will have to pay.

Contingent liabilities are not shown in the balance sheet.

EXAMPEL:

Liquidity

In other words, liquidity shows how much capital a company has available; it is the ratio between current assets to short-term debt.

Current assets include cash reserves and other assets that can be converted into cash.

Liquidity can also be used to describe a market as either a buyer’s market or a seller’s market. High liquidity in a market means that the turnover of goods is high, and there will typically be small price differences between the sellers in the market. This is called a seller’s market. On the other hand, a low liquidity market is referred to as a buyer’s market. In a buyer’s market, sellers will typically struggle to obtain higher prices for their products.

Payroll tax (lønsumsafgift)

Pension

Royalties

Scholarships and grants

Taxable Scholarships:

- Scholarships are generally considered taxable as personal income.

- They should be recognized and taxed in the year of the announcement of the scholarship.

Project Scholarships:

- Taxation occurs in the income year when the conditions are met.

Travel Scholarships I:

- Scholarships for study trips within Denmark are taxable.

- If the recipient has travel expenses abroad equal to the scholarship amount, it is not taxed.

Tax-Free Scholarships:

- Awards for creative and performing artists are tax-free and exempt from AM (labour market) contributions.

- Some scholarships have lower tax rates than regular income.

- To qualify for this lower tax rate, the scholarship must be a one-time payment from public funds, cultural foundations, etc., recognizing the recipient’s merits.

- A tax-free basic deduction is given, and only 85% of the amount exceeding this deduction is taxable income.

- The basic deduction is DKK 30,500 in 2023.

Example: Received applied award scholarship DKK 50,000 Tax-free basic deduction DKK 30,500 (2023) Difference DKK 50,000 – DKK 30,500 = DKK 19,500 Taxable amount: 85% of DKK 19,500 = DKK 16,575 Estimated tax, 40% of DKK 16,575 = DKK 6,630 Scholarship amount available after tax DKK 43,370

Project Scholarships II:

- Taxation occurs in the income year when the conditions are met.

- If project support is contingent on submitting accounts and the project’s implementation depends solely on the artist, taxation occurs upon receiving the grant.

- If the project’s completion depends on other significant factors, taxation is deferred until it is clear whether the project can be carried out.

Travel Scholarships II:

- Tax exemption is conditioned on the primary purpose of the journey being education or studying specific subjects individually.

- Excess amounts must be self-reported.

- If expenses for the mentioned purposes exceed the scholarship, no deduction is allowed unless the artist is self-employed.

AM Contribution on Scholarships:

- Scholarships are generally not subject to labour market contribution.

- Scholarships do not fall under the definition of remuneration; there is no direct performance of work or creation of a work.

- Scholarships are not subject to labour market contributions.

AM Contribution on Scholarships as Self-Employed:

- If a scholarship recipient is a self-employed artist, the amount is included in the business result and contributes to the basis for calculating labour market contributions.

- However, the artist can adjust the result of the business activity with the received scholarships when calculating the basis for labour market contributions.

Tax

As a lecturer, you may get students asking questions about the taxation of their artistic practices or enterprises. This may be the case whether you have a CVR number (CRN) or if you are working without a registered business.

As a self-employed person working in the arts, it is likely that you will have both an A and B income and have to pay both A and B taxes. You may also be liable for corporate taxes or dividend taxes. You can find more information about all of the above in CAKI’s Mini-guide to taxes here.

Tax Accounting

Tax accounting focuses on recording and reporting financial information relevant to meeting tax obligations.

It is used by businesses, organizations, and individuals to ensure compliance with tax laws and accurately calculate and report their tax liabilities.

Key components of tax accounting include:

Income: This includes all sources of revenue, such as sales income, interest earnings, investment income, and other forms of earnings.

Expenses: This encompasses all costs that can be deducted to reduce taxable income, such as business expenses, deductions, and losses.

Tax liability: This is the amount owed in taxes according to applicable tax laws. It may include income tax, VAT, property taxes, and any other taxes and duties.

Tax documentation: Tax accounting also involves all necessary documents and attachments required by tax authorities to substantiate the reported income, expenses, and deductions.

Filing: Once the tax accounting is completed, it is used to fill out and submit the required tax forms to the relevant tax authorities.

Tax accountings are crucial to ensure compliance with tax laws and to avoid any tax penalties.

Taxation of Your Own Business

Personally Owned Business

You are taxed on the business’s profits according to:

Corporate Taxation

The company’s profits are taxed at 22%.

You are taxed on:

- Salary (Personal Tax Rules)

- Dividends (up to DKK 56,500 at 27% – above that, 42%)

Read more about taxation of your own business here. (Skat website)

VAT

As a lecturer, you may get students asking questions about the taxation of their artistic practices or enterprises. This may be the case whether you have a CVR number (CRN) or if you are working without a registered business.

As a self-employed person working in the arts, it is likely that you will have both an A and B income and have to pay both A and B taxes. You may also be liable for corporate taxes or dividend taxes. You can find more information about all of the above in CAKI’s Mini-guide to taxes here.

VAT - partical VAT deduction (splitmoms)

Split VAT, also known as differential VAT, is applied when part of a company’s revenue is VAT-exempt while another part is subject to VAT. This means that you can only partially deduct the VAT and only on a limited (differential) portion of the expenses.

For instance, if your business earns revenue from VAT-exempt services like stage performances or education, alongside activities that are subject to VAT, you can’t deduct the VAT on expenses related to the VAT-exempt sales. However, expenses directly linked to the VAT-taxable sales allow for a full VAT deduction.

The partial VAT deduction applies to expenses related to both your VAT-taxable and VAT-exempt sales, like studio rent, insurance, or accounting fees.

To determine the amount of VAT you can deduct on expenses not directly linked to VAT-taxable sales, you’ll need a distribution key. This key indicates the proportion of VAT-taxable expenses you can deduct the VAT on.

For example, if your business has VAT-taxable sales of 150,000 DKK and VAT-exempt sales of 450,000 DKK, with a total turnover of 600,000 DKK, the calculation for the distribution key would be:

Total turnover: 600,000 DKK VAT-taxable sales: 150,000 DKK 25% of the total turnover

The distribution key for partial VAT deduction = 25%

This means you can deduct 25% of the VAT on expenses related to the operation of the business that cannot be directly attributed to either VAT-exempt or VAT-taxable sales.

For further details on split VAT, you can explore Skat’s website via this link: Skat’s website

Additionally, you can find more information about VAT calculations in online accounting programs like Dinero or Billy:

Virksomhedsordningen (for personally owned companies)

The “Virksomhedsordningen” is a taxation method where instead of personally taxing the entire profit, only 22% A-tax is paid on the profits retained within the company.

In personally owned companies, all profits are generally taxed personally. Hence, the tax authority considers the company’s profit as the owner’s personal income, and the profit is taxed accordingly. This applies regardless of whether the money is used for personal consumption or invested back into the company as savings.

However, under the “Virksomhedsordningen,” there’s a tax distinction between money withdrawn from the company for personal use and money invested in the company as savings. This differentiation exists only in accounting and not legally.

The decision to opt for the “Virksomhedsordningen” must be made at the time of filing the tax return.

It’s advisable to seek professional assistance if considering this scheme, as it requires maintaining specific records used in tax calculations.

For more information on this scheme, you can refer to this link: Virksomhedsordningen details

Årsopgørelsen

The “årsopgørelsen” is an overview of your tax affairs for the past year. It looks back at your income, deductions, and the tax you’ve paid during that period.

In March, you declare your final surplus or deficit on the annual statement (information form). Once you’ve filled it out and approved it, you receive your annual statement indicating whether you owe more in taxes or are due a refund.

For those running a self-employed business, it’s essential to report your business’s surplus or deficit (result) for the income year (previous year) by July 1st. After you’ve provided and approved your annual statement, you can determine whether you owe additional taxes or are eligible for a refund.

You can find more information about this process with Skat via this link: Skat’s annual statement details

GET CAKI’S MINIGUIDES HERE

CAKI Miniguide for VAT and Artist VAT

CAKI has published a number of publications and mini-guides to help you start your artistic business. You can read about the start-up, fundraising, portfolio and much more.

Helpful external releases

In the publication ‘Get control of the hassle’ you get a guide on how to work with bookkeeping and accounting in smaller companies:

As an artist, it can sometimes be difficult to place your income in line with the standards of tax law. ‘The Artist’s Taxation’ is a guide that guides you through the tax rules with a sure and loving hand:

Unique works of art are subject to special rules for VAT. The Association of Visual Artists has written this guide, which describes VAT registration, ordinary VAT and artist VAT:

And remember: you are always welcome to get personal advice at CAKI when there are questions about finances that you find difficult.