CAKI’s mini guide to VAT

When running a business, you need to know the VAT rules that apply to the type of business you have. You must have familiarized yourself with VAT before you register your company and get your CVR number, because during registration you will need to answer how your business or company will be registered for VAT.

Let’s begin by sorting out, what VAT actually is:

- VAT stands for “value added tax” and is a tax supplement on the sales price.

- VAT is added to sales of goods, services and art works.

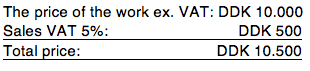

In Denmark, the standard VAT rate is 25% of the price of the item or service that is charged in VAT. This means that the VAT is 20% of the total price. It looks like this:

Most companies and self-employed are taxable for VAT. There are some business categories that are exempted from VAT, such as healthcare, banks, insurance, education – and artistic services.

However, the VAT exemption does not apply to the sale of works of art, but only to the sale of artistic services. When selling works of art, there is a special, reduced VAT rate called Artist VAT.

Registering for VAT

It is required by law that your business must be registered for VAT, when the taxable turnover (sales) exceeds DKK 50,000. If you in your company only make money from first-time sales of original works of art, you will only become liable to VAT when you sell for more than DKK 300,000 a year.

You must always register VAT for the part of the artistic business that is not directly exempt from VAT. This applies, for example, to exhibition fees and sales of reproductions. These activities are covered by the ordinary VAT rate of 25%, even if you as an artist use the Artist VAT-rate when selling original works.

In your business portfolio, you may well have a composition of goods and services where some are subject to the standard VAT rate, others are exempt from VAT, and your sales of original art works are using the Artist VAT rate.

VAT exemption

According to the VAT Act, author and composer activities and other artistic activities are exempt from VAT. Other artistic activities mean lectures, performances and the like. The exemption does not apply to the sale of works of art.

The sale of original works is not exempt from VAT. Rather, the sale of original art works is subject to Artist VAT of 5% – but only when you have sold original works for more than DKK 300,000 within a year.

At SKAT’s website you can always see which goods and services are exempt from VAT.

Artist VAT

Artist VAT is a special VAT rate of 5%, which applies to first-time sales of new, original works – which by the tax authorities are defined as ‘original artefacts.’ “Artefacts” is a definition used by SKAT, and it is their rules that you must follow. Pay attention to the fact that installations, films and digital art are NOT included as artefacts, and therefore are not liable for Artist VAT of 5% but are subject to the ordinary VAT rate of 25%. If you are in doubt as to whether a specific work must be imposed on artist VAT or ordinary VAT, you should always contact SKAT and get their assessment of the work.

If your sale of original works during the year is less that 300,000, you do not need to register for VAT. However, you will probably want to register for VAY regardless of what you expect your sales to be in order to get the VAT you have been paying for materials, goods and services returned. If your sales of new, original works exceed DKK 300,000, you will be subject to 5% VAT for the rest of the year and the following year. In that case, only 5% VAT will be payable on sales made after the registration obligation has occurred – it is not retroactive.

The obligation to register may occur during the year. When it ceases, it will always be at the end of a year. If the registration obligation has ceased, VAT will not be payable on sales after this time.

However, it may be an advantage to register the business for VAT from the beginning, even if you do not expect to sell for more than DKK 300,000. Then you can get a full VAT deduction for the purchase of materials and other necessary costs (such as rent and accounting assistance). If your business did not register for and is charging VAT, you are not allowed to deduct the ingoing VAT either.

Calculating artist VAT

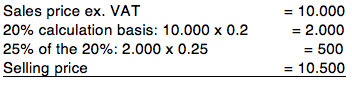

In Denmark, the basis for calculating the outgoing VAT at artists’ first sale is 20% of the sales price, equal to a VAT rate of 5%.

Or explained in another way:

The calculation basis for artist’s VAT is 20% of the sales price. When you need to find the VAT, you have to find 20% of the sales price ex. VAT, and then find 25% of the 20%. This means that the artist VAT constitutes 5% of the 20% of the sales price. The calculation for the VAT calculation thus looks like this:

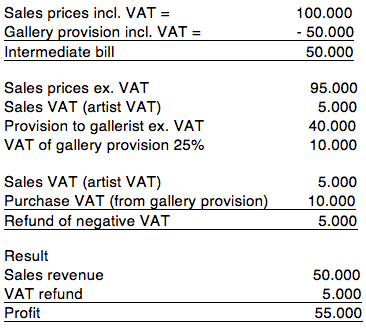

Artist VAT for sales via intermediary

Besides it being an advantage for you to register your business for VAT so that you can get the VAT returned on you business’ purchases, it is also an financial advantage for you to be registered for artist VAT if you are selling your works via an intermediary. Below is an example of the economy of a sale if you are registered for VAT and sell through a gallerist, who receives 50% of the sales sum in gross fee:

S

An artist, who is registered for the exhibition of works of art but not registered for VAT for the first sale of the artist’s own original works of art, can deduct the VAT on the expenses directly related to the exhibition of works of art, but will not be able to deduct VAT on expenses for the production of the artworks (materials, etc.).

Original works of art liable for artist VAT:

- Paintings, drawings and water colours/pastels made solely by hand (except drawings and hand decorated industrial products), collages and the likes.

- Original etchings, prints and lithography

- Original sculpture, regardless of the materials used

- Tapestries and wall textiles made by hand on the basis of original drawings made by the artist, as long as there is no more than one example of each

- Original ceramics and mosaics on wood

- Enamel works on cobber

- Photo signed and numbered in a number up to 30 copies

Split VAT (Differentiated VAT)

We work with differentiated VAT, or split VAT, when a part of the company’s revenue is VAT exempt, and another part is subject to VAT. This means that you can only partially deduct the VAT, and only on a limited (differentiated) portion of the expenses.

This typically applies if you have a business where you have income from VAT-exempt services, such as stage performances or teaching, and at the same time, you also have activities that are subject to VAT. Note that if your revenue from VAT-exempt activities exceeds 80,000 DKK, you must register for payroll tax (read about payroll tax elsewhere in the wiki).

You cannot deduct the VAT on expenses related to VAT-exempt sales. Full VAT deduction is allowed for expenses in the business that are directly related to taxable sales.

Partial VAT deduction is applied to expenses related to both your taxable and VAT-exempt sales. This can include things like studio rent, insurance, or expenses for an accountant or auditor.

Allocation Key for Split VAT

To determine how much VAT you can deduct on expenses that do not directly relate to taxable sales, you need to find an allocation key. The allocation key indicates how much of the VAT-liable expenses you are allowed to deduct the VAT on.

If your business has taxable revenue of 150,000 DKK and VAT-exempt revenue of 450,000 DKK, the calculation of the allocation key would look like this:

Total revenue: DKK 600,000

Taxable revenue: DKK 150,000

Equivalent to 25% of the total revenue

The allocation key for partial VAT deduction = 25%

This means that you can deduct 25% of the VAT on expenses that relate to the operation of the business but cannot be directly attributed to either VAT-exempt or taxable sales.

You can find more information about split VAT on the Danish Tax Authority’s website via this link: Skat’s website

You can also find more information about VAT calculations in online accounting programs such as Dinero or Billy.

How to post VAT in your bookkeeping

VAT is a tax you collect or pay on behalf of the State. Therefore, you must also post and record your VAT in a separate account so that it is separated from the other operations of your company.

If your company is registered for VAT, you must keep an account of the purchase and sale of goods and services and base your VAT accounts in that. At the end of each VAT period, you must calculate the VAT, which you will then have to report to the Tax Agency. The accounts must show how much you need to report and pay in VAT. It must include at least one account for respectively:

- Outgoing VAT

- Incoming VAT

The incoming VAT is your purchase tax – that is the one you pay when you buy something.

Your outgoing VAT is your sales tax – the one you charge when you sell something.

When you business have bookkeeping with VAT, you must divide the revenue into the VAT, which is entered on the balance sheet, and the income from the actual account revenue account.

If, for example, you have cash receipt of 1000 kroner with 25% VAT, then 1000 kroner in credit is posted on the cash account, 800 kroner in the debit on a sales account and 200 in the debit on a balance sheet for VAT. Correspondingly, the sale is divided into a VAT part and a revenue part.

You always have to post the VAT stated on the receipt or invoice, even if it is miscalculated.

The basis for calculating the incoming VAT (purchase VAT) is the cost of purchasing materials, etc. for the production. For most purchases, there is a right of deduction for the entire VAT amount, which basically means 25%. The possibility of a tax deduction comes into effect together with the registration of the business, so that from the beginning you can get a 25% tax deduction even if you have not yet started the sale in your company.

If you have trade with other countries, the VAT account must also include account for:

- VAT on goods purchased from abroad

- VAT on the purchase of services from abroad with a reverse obligation to pay

- Purchase of goods in other EU countries

- Purchase of reverse charge services in other EU countries

- Sales of goods to other EU countries

- Sale of reverse charge services in other EU countries

- Export to countries outside the EU, etc.

GET THE MINIGUIDE AS PDF HERE:

NEED MORE KNOWLEDGE?

CAKI has published more miniguides – have a look at the publications page here.