Registering a personally owned business – step by step

It is free to register a personally owned business. Before you begin the registration process, you need to prepare the following:

Select the business type

When registering a personally owned business, you can choose between a one-person business, a personally owned small business (if you have a VAT liable turnover under 50,000 DKK per year) or a partnership (if you are starting a business together with others). In this example, we will be using a one-person business (enkeltpersonsvirksomhed).

You can read more about the different business types in CAKI Miniguide – VAT and Business Types.

Choose a name

What will your business be called? When you have a solo business in which the activities revolve around you, it can make sense to use your personal name as the business name, for example, Ellen Madsen. Or, if you are building a more commercial brand such as a fashion brand or a music management agency, it may be appropriate for you to name the business something other than your name. If you decide to sell the business in the future, it would be impractical for the business to be named after you.

Choose VAT registration and payroll tax

Before you begin the registration, you need to sort out whether you need to register your business for VAT and if you should you register for artist VAT. Also, if you are going to be selling large quantities of goods to third world countries, you should familiarize yourself with registration requirements, before you begin the registration. Most personally owned businesses simply need to register for normal VAT, and if you are the first time seller of original works of art in your business, you must also register for artist tax, if you expect to be selling for more than 300.000 dkr. during the year. You should also register for payroll tax if your business sells VAT exempt services such as healthcare or teaching for more than 80,000 DKK per year.

If you are not sure how you should register your business, read CAKI Miniguide – VAT, artist tax and payroll tax or read more on the website of the Danish Tax Authority (skat.dk).

When you have completed the steps above, you are ready to begin registering your business. First, go to virk.dk. Choose “start virksomhed” (start business) and you will be asked to log in with your Nem ID. Once you have logged in, you are on your way.

On the following pages, we will go through the process as it appears when registering a one-person business.

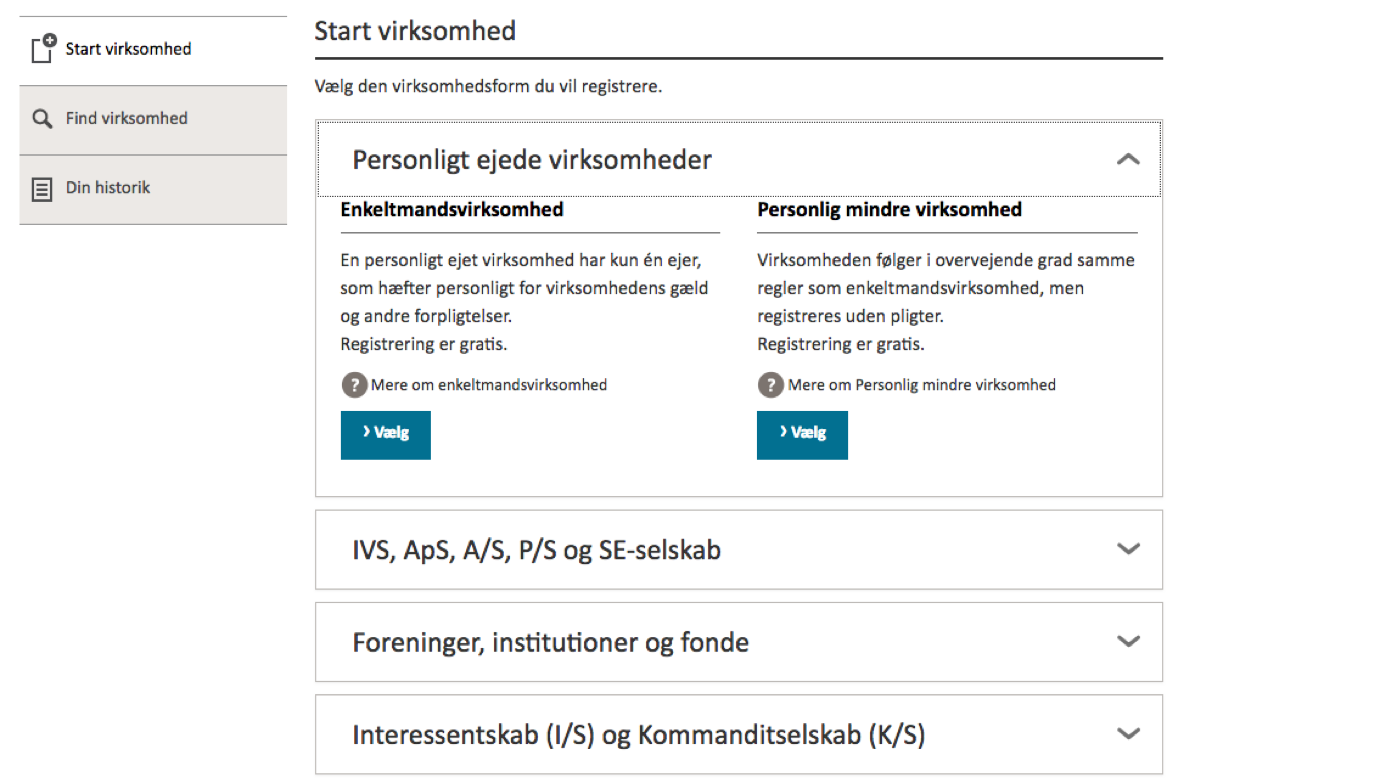

First, you will be asked to choose which type of business you wish to register. Select “Personligt ejede virksomheder” (personally owned businesses), since that is the example we are using here.

Start business // Start virksomhed

Search businesses // Find virksomhed

Your history // Din historik

Start business // Start virksomhed

Select the type of business you want to register // Vælg den virksomhedsform du vil registrere:

- Personally owned businesses // Personligt ejede virksomheder

- IVS, LLC, A/S, P/S and SE company // IVS, ApS, A/S, P/S og SE-selskab

- Associations, institutions and foundations // Foreninger, institutioner og fonde

- Partnership (I/S) and Limited partnership (K/S) // Interessentskab (I/S) og Kommanditselskab (K/S)

- Branch and foreign company // Filial og udenlandsk virksomhed

- Cooperatives // Andelsselskaber

- Special financial company, shipping, estate, bankruptcy estate, etc. // Særlig finansiel virksomhed, partrederi, dødsbo, konkursbo mv.

You will be given two options: one-person business and personal small business. In our example, you are using your business professionally, so you will choose a one-person business.

Step-by-step guide translation:

Start business // Start virksomhed

Select the business type you want to register // Vælg den virksomhedsform du vil registrere

Personally owned businesses // Personligt ejede virksomhed

One-person business // Enkeltmandsvirksomhed

A personally owned business has only one owner, who is personally responsible for the company’s debt and other obligations. Registration is free. // En personligt ejet virksomhed har kun en ejer, som hæfter personligt for virksomhedens gæld og andre forpligtelser. Registrering er gratis.

– More about one-person businesses // Mere om enkeltmandsvirksomhed

>Select // Vælg

Personal small business // Personlig mindre virksomhed

The business predominantly follows the same rules as a one-person business but is registered without obligations. Registration is free. // Virksomheden følger i overvejende grad samme regler som enkeltmandsvirksomhed, men registreres uden pligter. Registreringen er gratis.

– More about personal small business // Mere om Personlig mindre virksomhed.

>Select // Vælg

Start

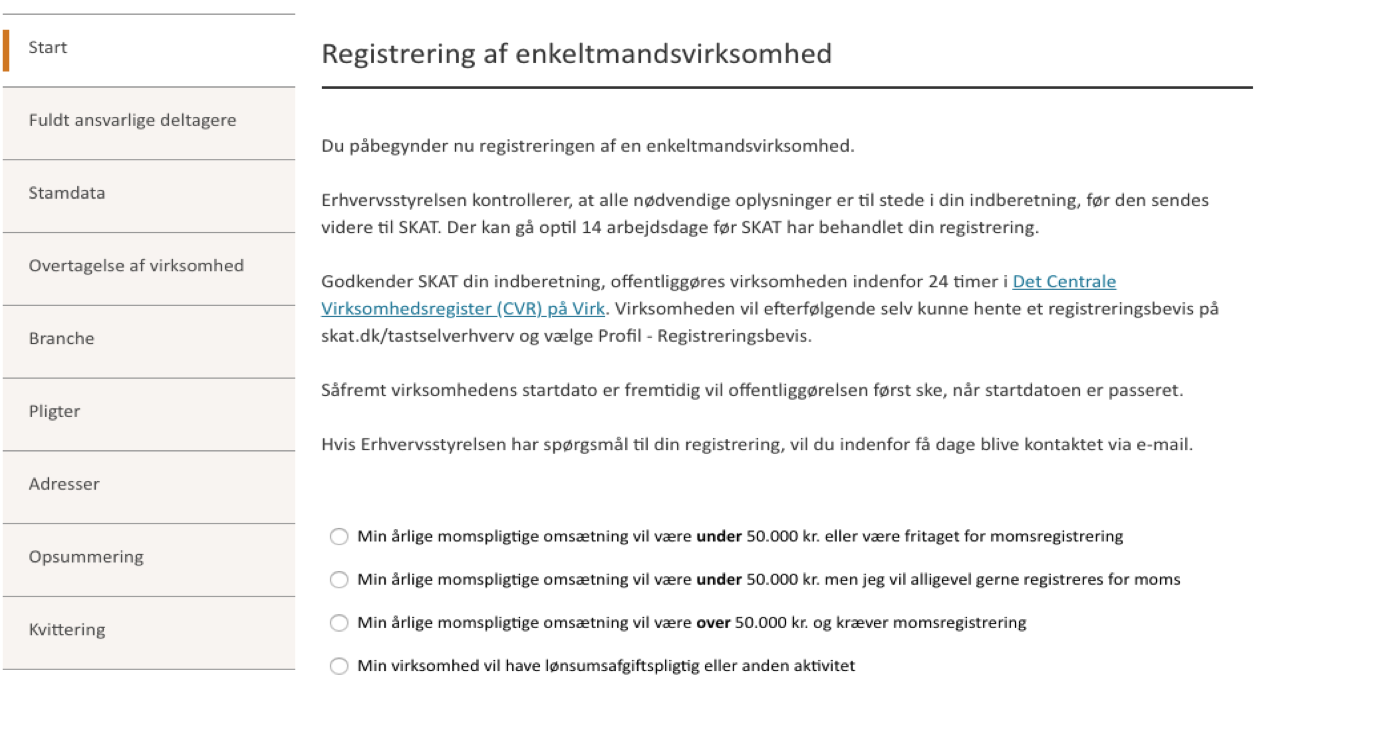

You are given four options. If you are starting a business because you will be using it in your professional practice, select the third option: My annual taxable income will be over 50,000 DKK. The first two options, in which your annual income is less than 50,000 DKK, are intended for those starting a hobby business. Select the last option regarding payroll tax if you have payroll taxable activities exceeding 80,000 DKK in a 12-month period.

Registration of one-person business // Registrering af enkeltmandsvirksomhed

You are now beginning registration of a one-person business. // Du påbegynder nu registreringen af enkeltmandsvirksomhed.

The Business Authority checks whether you have provided all necessary information before sending your application to the Danish Tax Authority (SKAT). It may take up to 14 business days for the Danish Tax Authority to process your registration. // Erhvervsstyrelsen kontrollerer, at alle nødvendige oplysninger er til stede i din indberetning, før den sendes videre til SKAT. Der kan gå op til 14 arbejdsdage før SKAT har behandlet din registering.

If the Danish Tax Authority approves your application, the business will be public within 24 hours in the Central Business Registry (CVR) on virk.dk. The business will thereafter be able to obtain proof of registration (registreringsbevis) from skat.dk/tastselverhverv by selecting “Profil – Registreringsbevis.” // Godkender SKAT din indberetning, offentliggøres virksomheden indenfor 24 timer i Det Centrale Virksomhedsregister (CVR) på Virk.dk. Virksomheden vil efterfølgende selv kunne hente et registreringsbevis på skat.dk/tastselverhverv og vælge Profil-Registreringsbevis.

If the business has given a start date which is in the future, the business will be made public once that date has passed. // Såfremt virksomhedens startdato er fremtidig vil offentliggørelsen først ske, når startdatoen er passeret.

If the Business Authority has questions about your registration, they will contact you via email within a few days.// Hvis Erhvervsstyrelsen har spørgsmål til din registrering, vil du indenfor få dage blive kontaktet via e-mail.

○ My annual taxable revenue will be under 50,000 DKK or is VAT exempt // Min årlige momspligtige omsætning vil være under 50.000 kr. eller være fritaget for momsregistrering.

○ My annual taxable revenue will be under 50,000 DKK but I still want to register for VAT // Min årlige momspligtige omsætning vil være under 50.000 kr., men jeg vil alligevel gerne registreres for moms.

○ My annual taxable revenue will be more than 50,000 DKK and requires VAT registration // Min årlige momspligtige omsætning vil være over 50.000 kr. og kræver momsregistrering.

○ My business will have payroll taxable or other activity // Min virksomhed vil have lønsumsafgiftspligtig eller anden aktivitet

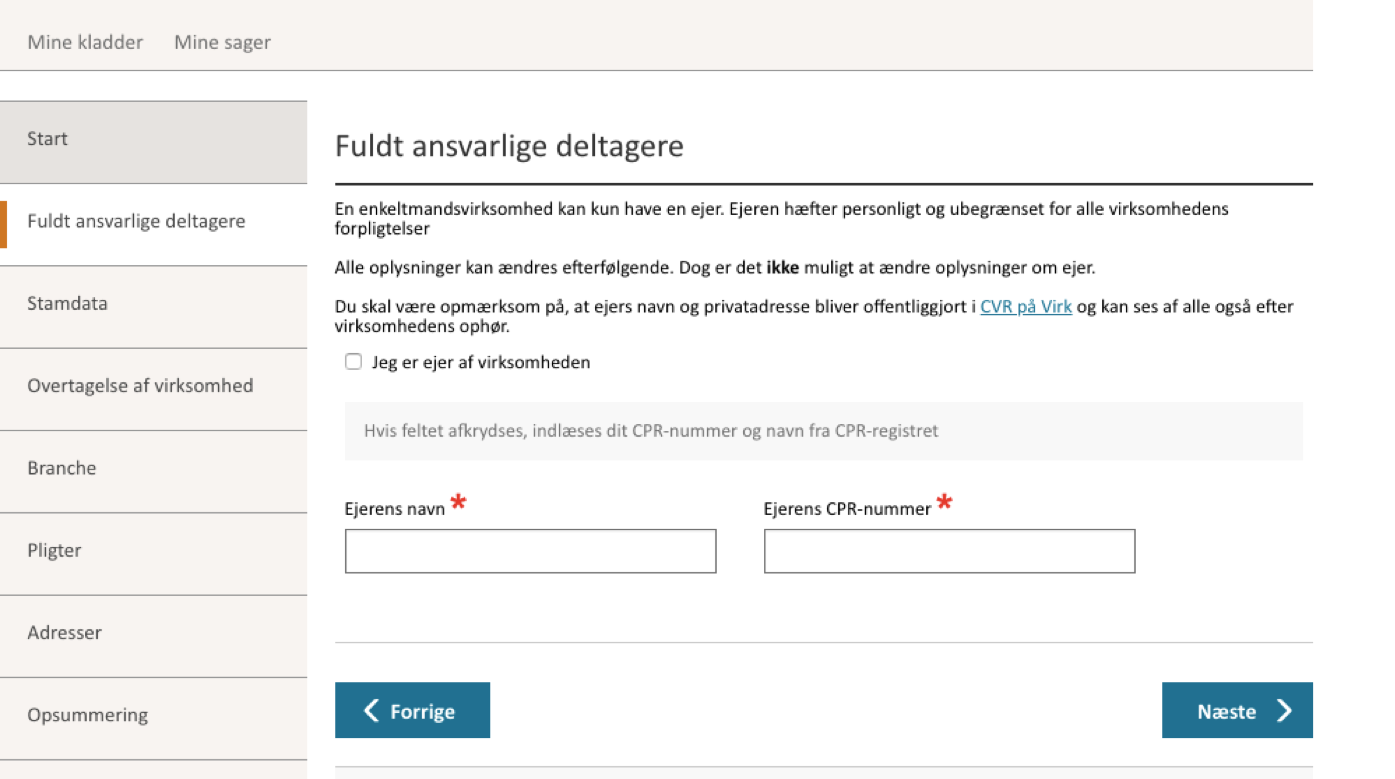

Fully responsible parties

If you own the business, check “I am the business owner.” Your name and CPR number will automatically appear in the two boxes below, since you are logged in with your Nem ID. The system may take some time. Wait to proceed until your name appears in the box. You may need to refresh the page or go back if it is taking an unusually long time.

Fully responsible parties // Fuldt ansvarlige deltagere

A one-person business can only have one owner. The owner is without limit personally responsible for all obligations of the business. // En enkeltmandsvirksomhed kan kun have en ejer. Ejeren hæfter personligt og ubegrænset for alle virksomhedens forpligtelser.

The submitted information can be changed, but it is NOT possible to change owner information once it is submitted.// Alle oplysninger kan ændres efterfølgende. Dog er det ikke muligt at ændre oplysninger om ejer.

Please be aware that the owner’s name and personal address will be made public on the Central Business Registry and will still be visible after the business closes.// Du skal være opmærksom på, at ejerens navn og privatadresse bliver offentliggjort i CVR på Virk og kan ses af alle også efter virksomheden ophør.

☐ I am the owner of the business // Jeg er ejer af virksomheden

When the box is checked, the name and CPR number will automatically load from the CPR registry // Hvis feltet afkrydses, indlæses dit CPR-nummer og navn fra CPR-registret

Owner’s name * // Ejers navn Owner’s CPR number * // Ejers CPR nummer

<Previous // Tidligere Next> // Næste

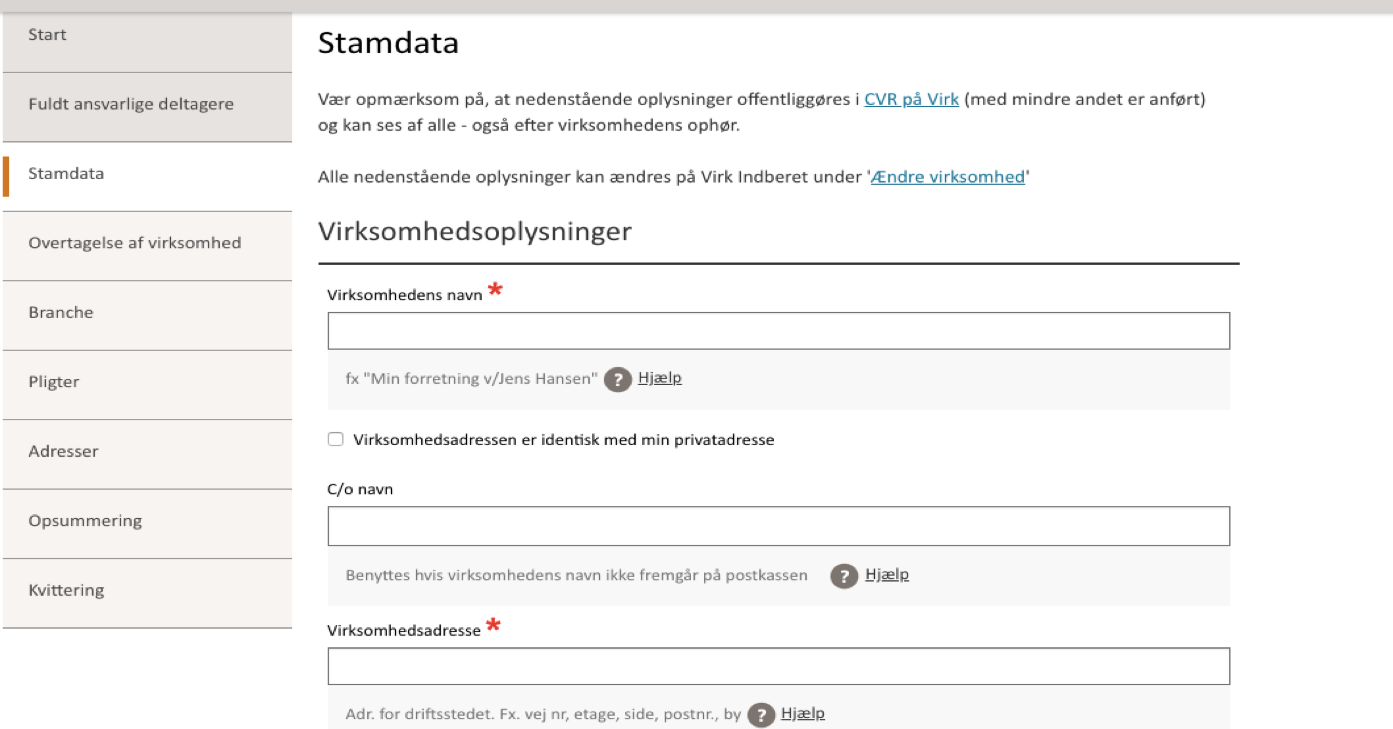

Basic info

Now you will begin filling out the forms for your business. You will begin by entering the name of your business. You will be able to change the name later if necessary, but be aware that it is a rather bureaucratic process.

Unless you have a business address, it makes sense to register your own address as the business address – this way the authorities are automatically notified if you move.

Basic info // Stamdata

Please be aware that information entered below will be made public on CVR på Virk (unless otherwise requested) and can still be seen after the business closes. // Vær opmærksom på, at nedenstående oplysninger offentliggøres i CVR på Virk (Medmindre andet er anført) og kan ses af alle – også efter virksomhedens ophør.

All information below can be changed on the Virk Indberet page under “Ændre virksomhed” (“Change business”) // Alle nedenstående oplysninger kan ændre på Virk indberet under ‘Ændre virksomhed’.

Business info // Virksomhedsoplysninger

Business name * // Virksomhedens navn

i.e. “My business v/ Jens Hansen” ? – Help // fx, ‘Min forretning v/Jens Hansen’ ? – Hjælp

The business address is the same as my private address // Virksomhedsadresse er identisk med min privatadresse

C/o name // C/o navn

Used if business name does not appear on mailbox ?- Help // Benyttes hvis virksomhedens navn ikke fremgår af postkassen ? – Hjælp

Business address * // Virksomhedsadresse

Address of place of operation, i.e. street address, floor, side, postal code, city ?- Help // Adr. for driftsstedet. Fx. vej nr, etage, side, postnr. by ? – Hjælp

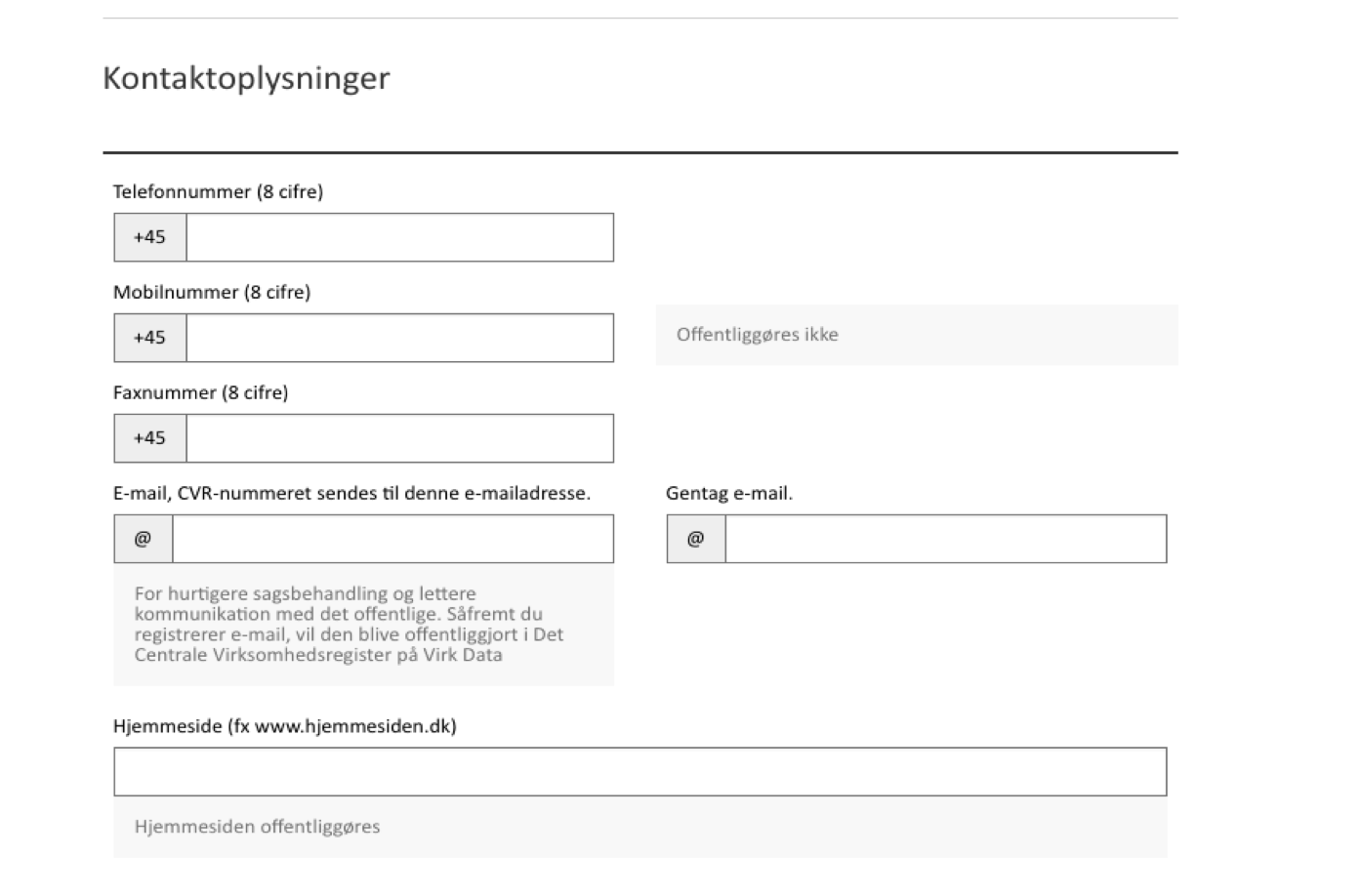

Next, enter your contact information

Contact information // Kontaktoplysninger

Phone number (8 digits) // Telefnnummer ( 8 cifre)

Mobile phone number (8 digits) Will not be publicly listed // Mobilnummer (8 cifre) Offentliggøres ikke

Fax number (8 digits) // Faxnummer (8 cifre)

E-mall address where CVR number will be sent // Em-mail, CVR-nummeret sendes til denne e-mailadresse

Repeat e-mail address // Gentag e-mail

For faster processing and easier official communication. If you register your e-mail address, it will be visible in the Central Business Registry on Virk Data // for hurtigere sagsbehandling og lettere kommunikation med det offentlige. Såfremt du registerer e-mail, vil den blive offentliggjort i Det Centrale Virksomhedsregister på Virk Data.

Website (i.e. www.website.dk) // Hjemmeside ( fx www.hjemmeside.dk)

The website will be made public. // Hjemmesiden offentliggøres

Be sure to select the option of ad protection to avoid receiving junk mail and telemarketing.

Ad protection // Reklamebeskyttelse

I would like ad protection in CVR // Der ønskes reklamebeskyttelse i CVR

? – Help // ?- Hjælp

< Previous Next > // < Forrige Næste >

Transfer of business

You are starting a new business, you will select the first option: No, it is a new business

Are you taking over an existing business? // Har du overtaget en eksisterende virksomhed?

Have you bought or taken over all or part of a business? // Har du købt eller overtaget hele eller dele af en virksomhed?

No, it is a new business // Nej, det er en ny virksomhed

Yes, the business is taking over (all or part of) another business. // Ja, virksomheden overtager (hele eller dele af) en anden virksomhed

Industry

Next, you will select your industry code. The industry you select will for example affect the kinds of deductions you will be able to make in your bookkeeping, and it is important for Denmark’s Statistics that the business is placed in the correct industry. You should change your industry code if another activity is dominant for a longer period (approximately two years). If your revenue from a secondary activity exceeds 300,000 DKK annually, and if it makes up at least 10% of the combined revenue, you should register a secondary industry. You may register as many as three secondary industries if the revenue of secondary activities fulfills the above requirements.

If you are registering an artistic business, you will probably be in one of the following industries:

- 03.00 Artistic creation

- 01.20 Independent practicing performers

- 11.10 Production of film, video and TV programs

- 11.00 Architect company

- 10.10 Industrial design and product design

- 10.20 Communication design and graphic design

- 10.30 Interior architects and space design

Business Industry Codes // Virksomhedens branchekode

Find Industry // Find branche

Search Industries * // Søg efter branche

You must choose an industry code for your business. The code describes the work of your business. Find your code by entering a search term for the type of work in the search field. Use the shortest form (i.e. coach, builder, consultant) – this will yield the most results. Look through the industries shown and select one. You may choose an industry code now and change it later. // Du skal vælge en branchekode til din virksomhed. Den skal beskrive, hvad du beskæftger dig med. Du finder den ved at skrive et søgeord for det, virksomheden arbejder med, i søgefeltet. Det er godt at skrive en helt kort form (fx coach, murer, konsulent) – det giver mange brancher at vælge imellem. Kig de viste brnacher igennem og beslut dig for en branche nu, men den kan ændres senere.

If you need to familiarize yourself with industry codes, you can see them here: https://indberet.virk.dk/integration/ERST/Branchekode

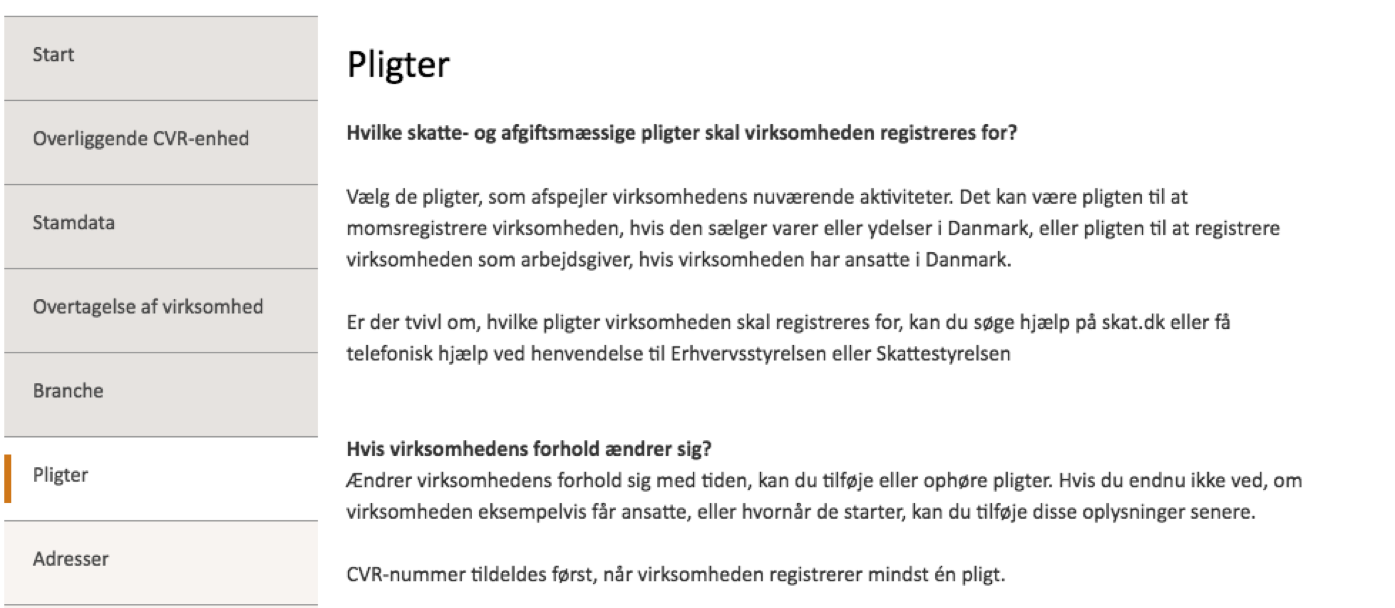

Obligations

You will now choose how your business will be registered for VAT, payroll, etc. These are known as ‘obligations’. We will cover the options one by one.

Obligations // Pligter

Which tax and expense obligations should the company be registered for? // Hvilke skatte- og afgiftsmæssige pligter skal virksomheden registreres for?

Select the obligations which reflect the current activities of the business. The business may be required to be registered for VAT tax if it sells services in Denmark or to register as an employer if it has employees in Denmark. // Vælg de pligter, som afspejler virksomhedens nuværende aktiviteter. Den kan være pligten til at momsregistrere virksomhedens, hvis den sælger varer eller ydelser i Danmark, eller pligten til at registere virksomheden som arbejdsgiver, hvis virksomheden har ansatte i Danmark.

If you are not sure which obligations the business should be registered for, you can search for help at skat.dk or receive assistance by phone by contacting the Danish Business Authority or the Danish Tax Agency. // Er der tvivl om, hvilke pligter virksomheden skal registreres for, kan du søge hjælp på skat.dk eller få telefonisk hjælp ved henvendelse til Erhvervsstyrelsen eller Skattestyrelsen.

If the business situation changes? // Hvis virksomhedens forhold ændrer sig?

You may add or remove obligations as the situation of the business changes over time. If you do not yet know whether the business will have employees or when they will start, you may add this information later. // Ændrer virksomhedens forhold sig med tiden, kan du tilføje eller ophøre pligter. Hvis du endnu ikke ved, om virksomheden eksempelvis får ansatte, eller hvornår de starter, kan du tilføje disse oplysninger senere.

A CVR number is assigned once the business registers for at least one obligation. // CVR-nummeret tilmeldes først, når virksomheden registrerer mindst én pligt.

First, choose how you will be registered for VAT. Begin by choosing the normal VAT, since there are generally no special tax rules your business will be obligated to follow.

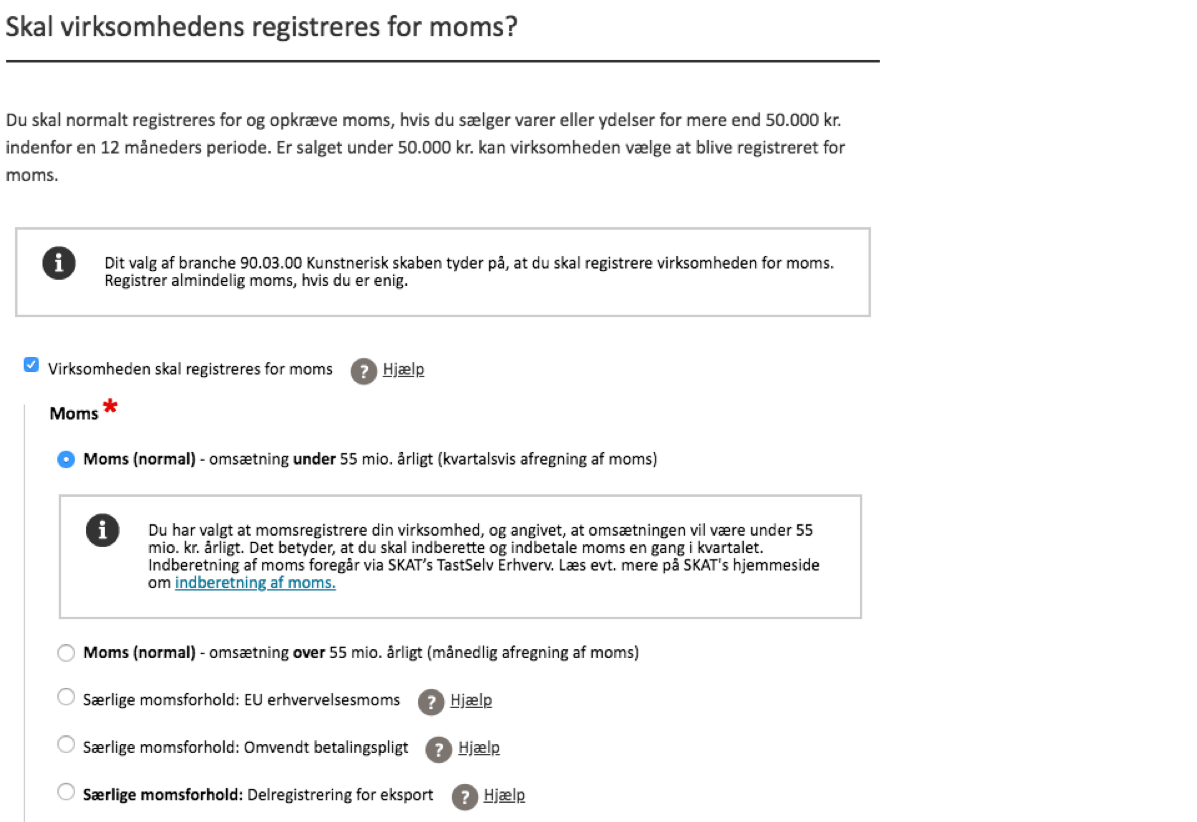

Should the business register for VAT?

You should generally register to charge VAT if you are selling goods or services for more than 50,000 DKK within a 12-month period. If sales are under 50,000 DKK, the company can choose to be registered for VAT.

Should the business register for VAT? // Skal virksomheden registreres for moms?

You should generally register to charge VAT if you are selling goods or services for more than 50,000 DKK within a 12-month period. If sales are under 50,000 DKK, the company can choose to be registered for VAT. // Du skal normalt registeres for og opkræve moms, hvis du sælger varer eller ydelser for mere end 50.000 kr. indenfor en 12 måneders periode. Er salget under 50.000 kr. kan virksomheden vælge at blive registreret for moms.

Your selection of industry 93.03.00 Artistic creation indicates that you should register your business for VAT. Register for normal VAT if you agree. // Dit valg af branche 90.03.00 Kunstnerisk skaben tyder på, at du skal registere virksomheden for moms. Registerer almindelig moms, hvis du er enig.

The business is registering for VAT ? – Help // Virksomheden skal registereres for moms ? -Hjælp

VAT * // Moms

VAT (normal) – revenue under 55 million annually (quarterly calculation of VAT) // Moms (normal) – omsætning under 55 mio. årligt (kvartalsvis afregning af moms)

You have chosen to register your business for VAT and indicated that the revenue will be under 55 million DKK annually. This means that you must report and pay VAT once per quarter. Reporting of VAT is done through SKAT TastSelv Erhverv. For more information, see the SKAT website section “indberetning af moms” (reporting of VAT). // Du har valgt, at momsregistrere din virksomhed, og angivet, at omsætningen vil være under 55 mio. kr. årligt. Det betyder, at du skal indberette og indbetale moms en gang i kvartalet. Indberetning af moms foregår via SKAT’s TastSelv Erhverv. Læs evt. mere på SKAT’s hjemmeside om indberetning af moms.

VAT (normal) – revenue over 55 million annually (monthly calculation) // Moms (normal) – omsætning på over 55 mio. årligt (månedlig afregning af moms)

Special VAT conditions: EU acquisition VAT ?Help //

Særlige momsforhold: EU erhvervelsesmoms ?Hjælp

Special VAT conditions: Reverse charge ?Help // S

ærlige momsforhold: Omvendt betalingspligt ?Hjælp

Special VAT conditions: Partial registration for export ?Help //

Særlige momsforhold: Delregistrering for eksport ?Hjælp

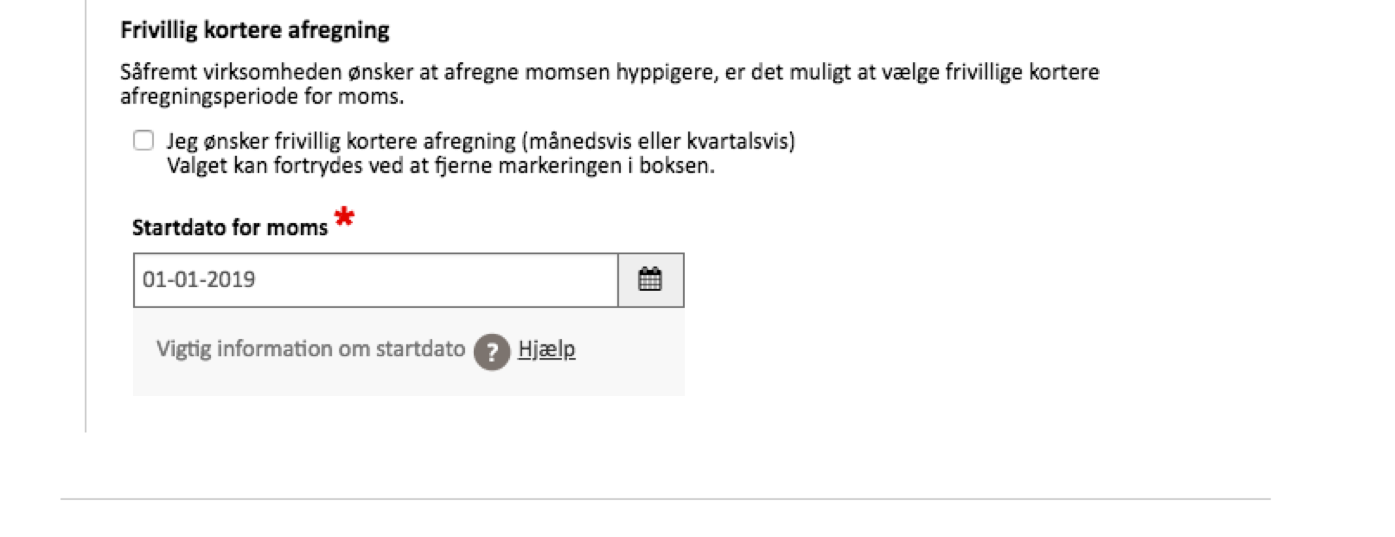

Next, you will select how often and when you will start paying VAT. If you want to go back to a previous year, you should call the Danish Tax Authority and ask how that will affect your taxes for the previous year.

If you will need to calculate VAT more regularly than on a quarterly basis, you will also indicate that here. This may be necessary if your business involves large events such as festivals or concerts.

With normal VAT registration, VAT should be calculated on a quarterly basis during the first two years of operation of your business. After that, the calculation will automatically switch to once every six months.

If a shorter calculation period is desired, it is possible to select an optional shorter calculation period for VAT.

Optional shorter calculation // Frivillig kortere afregning

If a shorter calculation period is desired, it is possible to select an optional shorter calculation period for VAT. // Såfremt virksomheden ønsker, at afregne momsen hyppigere, er det muligt at vælge frivilig kortere afregningsperiode for moms.

I want to choose a shorter calculation period (monthly or quarterly) // Jeg ønsker frivillige kortere afregning (månedsvis eller kvartalsvis).

This choice can be changed by unchecking the box. // Valget kan fortrydes ved at fjerne markeringen i boksen.

Start date for VAT* // Startsdato for moms

Important information about start date ? Help // Vigtig information om startsdato ?Hjælp

If you choose to start your business on a date in the future be aware of the following:

PLEASE NOTE: Future start date // OBS: Fremtidig startsdato

If your start date is in the future, be aware that you will not be able to: // Hvis din startsdato er fremtidig, skal du være opmærksom på, at du IKKE kan:

- Get a business account / business checking account at a financial institution // Få en erhvervskonto/ nemkonto erhverv i et pengeinstitut

- Order Dankort terminals / business mobile pay or other payment solutions // Bestille dankortterminal/ mobilpay erhverv eller andre betalingsløsninger

- Order a business NemID // Bestille NemId erhverv

- Make VAT exempt business purchases such as inventory, goods, machines etc. // Købe ind og få momsafdrag til din virksomhed. F.eks. inventar, varer, maskiner m.m.

This is because your CVR number is not valid before the date you have chosen as start date and will not appear in the Central Business Registry (CVR.dk) before the date has passed. // Dette skyldes at dit CVR nummer ikke er gyldigt før den dato du har valgt som startdato og vil ikke blive påvist på CVR.dk før datoen er passeret.

Also, be aware that changes or closing of business can not occur before the start date. // Opmærksomheden henledes også på, at der ikke kan ske ændring elelr ophør af virksomheden før startdatoen er passeret.

Confirm below that you still want a future start date, or change the start date // Bekræft nedenfor at du forsat ønsker en fremtidig startsdato eller ret startdatoen

– I confirm that I understand the consequences of future start date * // Jeg bekræfter, at jeg har forstået konsekvenserne ved en fremtidig startdato.

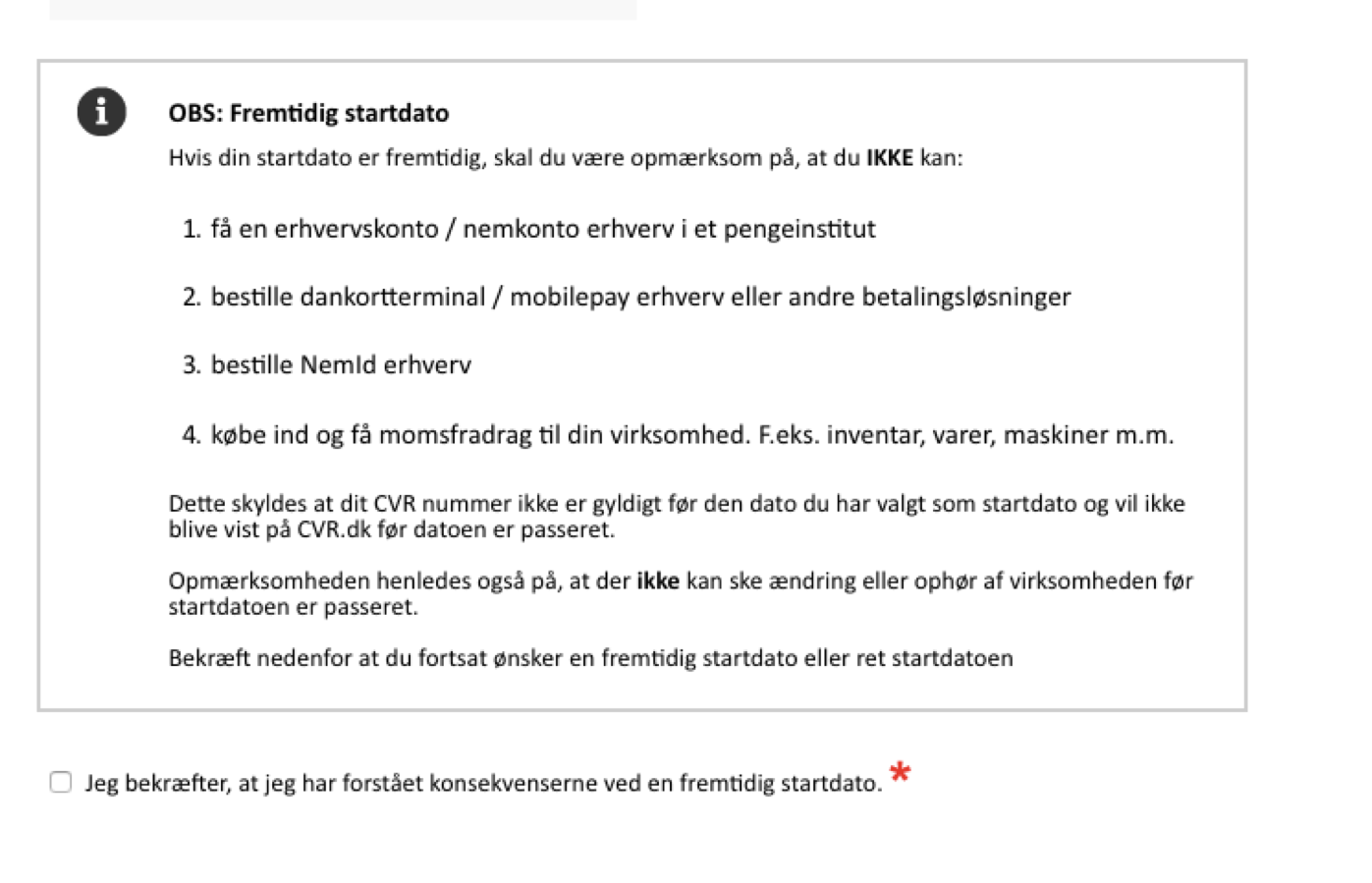

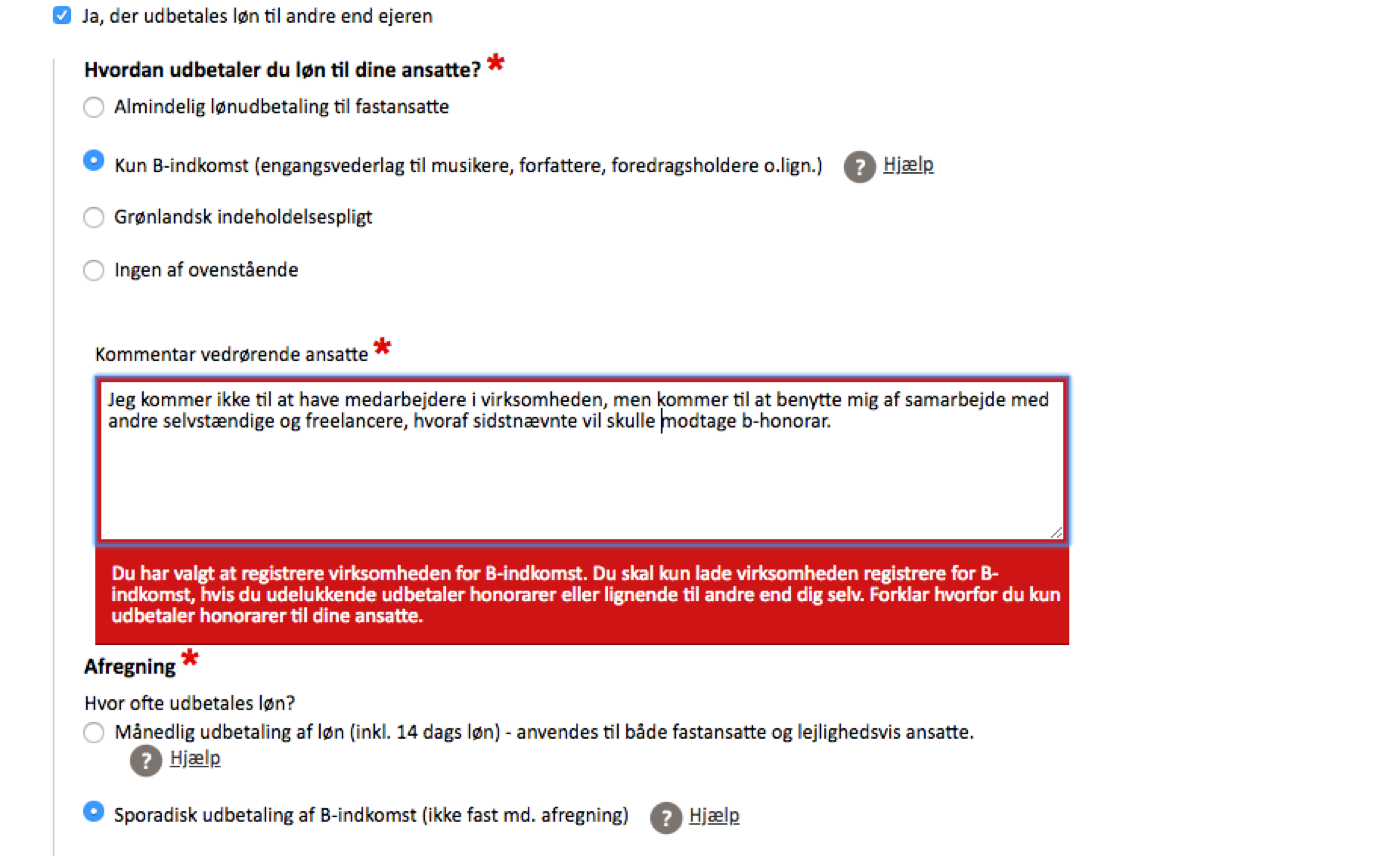

Next you will be asked whether you will pay wages to persons other than the owner. Answer “yes,” because this means you will be able to pay B-honorariums to persons you work with who do not have CVR numbers. For example, if you have a performance where you have hired two dancers who do not have CVR numbers, you can pay them in the form of B-honorariums.

You must of course also answer “yes” if you will have regular employees in your business. Be aware that you yourself are not employed by your business. In a personally owned business, you are the owner, and you receive money from your business via payments to the owner. The annual financial result appears in the annual accounts, and this is the result you will enter in the section “results from own business” on your annual tax return to SKAT.

Will wages be paid to persons other than the owner? // Skal der udbetales løn til andre end ejeren?

If wages will be paid to persons other than the owner, the business must be registered as an employer. The information can be changed on virk.dk in the event that the business begins having employees at a later date. For more information about obligations regarding employees, see the guide “AnsætSelv”. // Skal der udbetales løn til andre end ejeren, skal virksomheden registeres som arbejdsgivere. Får virksomheden senere ansatte kan oplysningerne ændres i virksomhedsregistreringen på Virk.dk. Få mere information om pligter vedrørende ansatte – Se guiden ‘AnsætSelv’.

Yes, wages will be paid to persons other than the owner // Ja, der udbetales løn til andre end ejeren.

Once you have answered “yes,” you will be able to choose how the wages will be paid. If you expect to pay B-honorariums, you will be asked to comment after indicating your choice. You may do this as follows:

Yes, wages will be paid to persons other than the owner // Ja, der udbetales løn til andre end ejeren.

How will you pay wages to your employees?* // Hvordan udbetaler du løn til dine ansatte?

Normal wage payment to fixed employees // Almindelig lønudbetaling til fastansatte

Only B-income (one-time payments to musicians, authors, lecturers etc.) ?help // Kun B-indkomst (engagnsvederlag til musikere, forfattere, foredragsholdere o.lign.) ?Hjælp

Greenlandic withholding obligation // Grønlandske indeholdspligt

None of the above // Ingen af ovenstående

Comments regarding employees* // Kommentar vedrørende ansatte

I will not have regular employees in the business, but will make use of collaborations with other independents and freelancers who will receive B-honorariums. // Jeg kommer ikke til at have medarbejdere i virksomheden, men kommer til at benytte mig af samarbejde med andre selvstændige og freelancere, hvorfra sidstenævnte vil skulle modtage b-honorar.

You have chosen to register your business for B-income. You should only register for B-income if you will only pay honorariums or similar to persons other than yourself. Please explain why you only pay honorariums to your employees. // Du har valgt at registere virksomheden for B-indkomst. Du skal kun lade virksomheden registere fro B-indkomst, hvis du udelukkende honorarer eller lignende til andre end dig selv. Forklar hvofor du kun udbetaler honorarer til dine ansatte.

Accounting* // Afregning

How often are wages paid? // Hvor ofte udebetales løn?

Monthly disbursement of wages (including 14 days wage) – for both fixed employees and occasional employees. // Måndelig udbetaling af løn (inkl. 14 dags løn) anvendes ti både fastansatte og lejlighedsvis ansatte.

? Help // ? Hjælp

Sporadic payment of B-income (not fixed monthly accounting) ?Help // Sporadisk udbetaling af B-indkomst (ikke fast md. afregning)

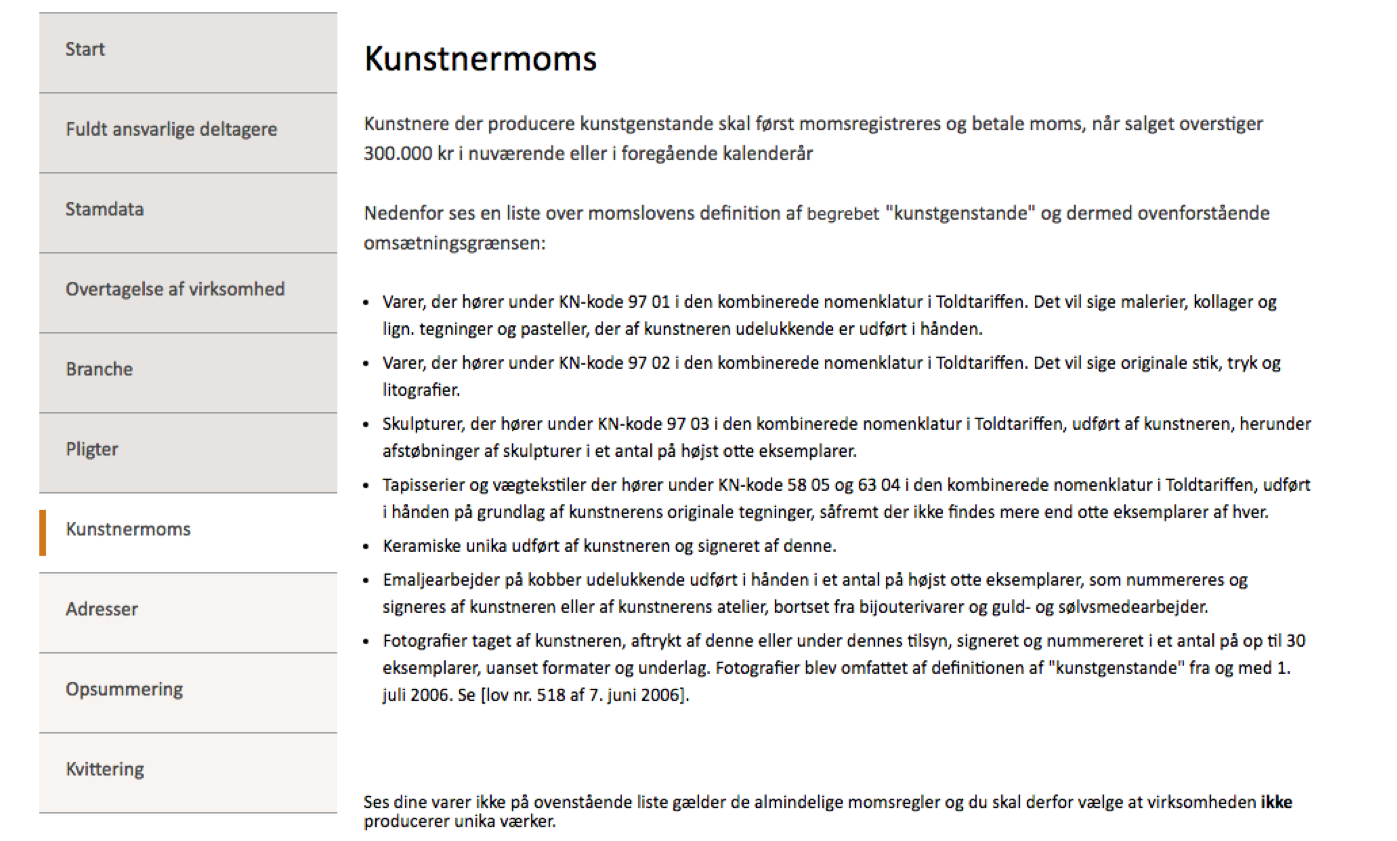

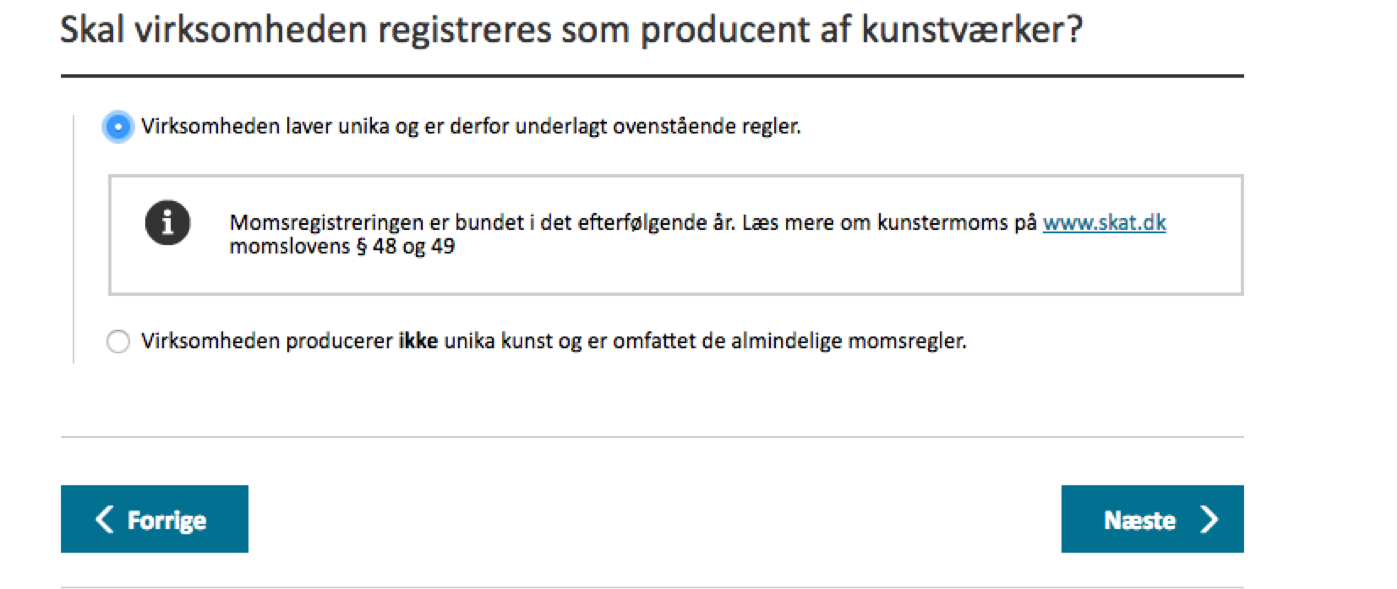

Now you must address whether your business will be registered for artist VAT. The Danish Tax Authority is quite precise regarding which works are considered original works of art according to their definition.

Artist tax // Kunstnermoms

Artists who produce works of art will be required to register for and pay VAT tax once sales exceed 300,000 DKK in the current or previous calendar year. // Kunstnere der producerer kunstgenstande skal først momsregisteres og betale moms, når salget overstiger 300.000 kr i nuværende eller foregående kalenderår.

Below is a list of the VAT law’s definition of the term “work of art” and thus the above revenue limit: // Nedenfor ses en liste over momslovens definition af begrebet ‘kunstgenstande’, og dermed ovenforstående omsætningsgrænsen:

- Items belonging to KN code 97 01 in the combined nomenclature in the customs tariff. These are paintings, collages and similar drawings and pastels that the artist has made solely by hand. // Varer, der hører under KNkode 9701 i den kombinerende nomenklatur i Toltariffen. Det vil sige malerier, kollager og lign. tegninger og pasteller, der af kunstneren udelukkende er udført i hånden.

- Items belonging to KN code 97 02 in the combined nomenclature in the customs tariff. These are original engravings, lithographs and prints. // Varer, der hører under KN-koden 9702 i den kombinerede nomenklatur i toldtariffen. Det vil sige orginale strik, tryk og litografier.

- Sculptures belonging to KN code 97 03 in the combined nomenclature in the customs tariff. These are sculptures made by the artist, including castings of sculptures in eight or fewer copies. // Skulpturer, der hører under Kn-koden 9703 i den kombinerede nomenklatur i Toltariffen, udført af kunstneren, herunder afstøbninger af skulpturer i et antal på højest otte eksemplarer.

- Tapestries and wall textiles belonging to KN code 58 05 and 63 04 in the combined nomenclature in the customs tariff, made by hand based on the artist’s original sketches as long as there are only eight or fewer copies of each. // Taoisseringer og vægtekstiler der hører under Kn-koden 5805 og 6304 i den kombinerede nomenklatur i Toldtariffen, udført i hånden på grundlag af kunstnerens orginale tegnigner, såfremt der ikke findes mere end otte eksemplarer af hver.

- Unique ceramics made and signed by the artist. // Keramiske unika udført af kunstneren og signeret af denne.

- Copper enamel works made solely by hand in up to eight copies numbered and signed by the artist or the artist’s studio with the exception of jewellery items and gold and silver works. // Emaljearbejde på kobber udelukkende udført i hånden i et antal på højest otte eksemplarer, som nummereres og signeres af kunstnerens eller af kunstnerens atelier, borset fra biljouterivarer og guld – og sølvsmedarbejdere.

- Photographs taken by the artist, printed by the artist or under their supervision, in up to 30 copies in any format and material. Photographs are included in the definition of “works of art” from and including July 1, 2006. See [Law no. 518 of July 7, 2006). // Fotografier taget af kunstneren, aftrykt af denne eller under dennes tilsyn, signeret og nummeret i et antal på op til 30 eksemplarer, uanset formatere og underlag. Fotografier blev omfattet af definitionen af ‘kunstgenstande’ fra og med 1. juli 2006. Se [lov nr. 518 af 7. juni 2006].

If your goods are not listed above, regular VAT rules apply, and you should therefore indicate that the business does not produce unique works.

Should the business be registered as producer of art works // Skal virksomheden registeres som producent af kunstværker?

The business makes unique works and is therefore subject to the above rules // Virksomheden laver unika og er derfor underlagt ovenstående regler.

VAT registration is bound in the following year. Read more about artist tax at www.skat.dk // Momsregistreringen er bundet i det efterfølgende år. Læs mere om kunstnermoms på www.skat.dk

VAT law § 48 and 49 // Momslovens § 48 og 49

The business does not produce unique art and is therefore subject to the normal VAT rules. // Virksomhedens producerer ikke unika kunst og er omfattet de almindelige momsregler.

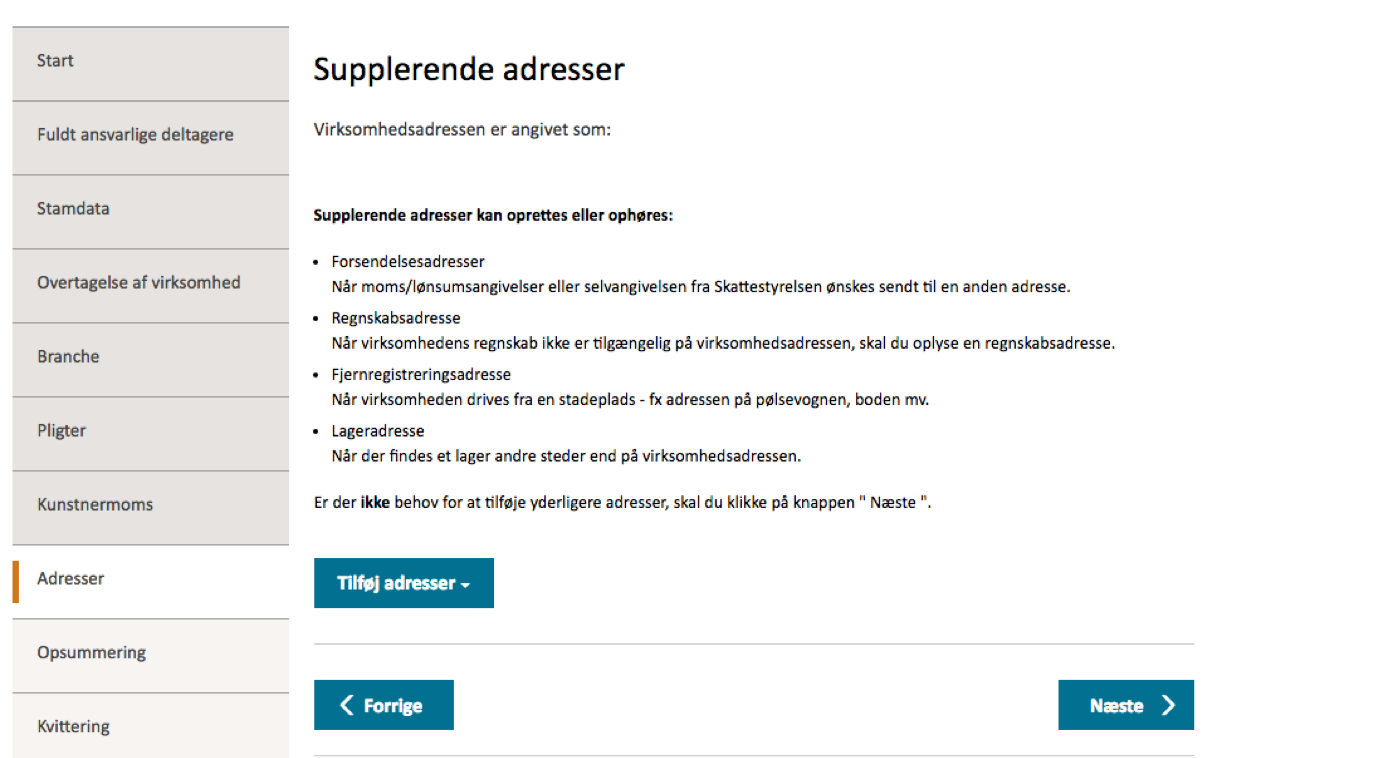

Finally, indicate any supplementary addresses for your business.

Supplementary addresses // Supplerende adresser

The business address is listed as: // Virksomhedsadressen er angivet som:

Supplementary address can be established or ceased: // Supplerende adresser kan oprettes eller ophøres

Mailing address – When you wish to have VAT/ payroll returns or tax return mailed to another address. // Forsendelsesadresser – Når mom/lønsumsangivelser eller selvangivelsen fra Skattestyrelsen ønskes sendt til en anden adresse.

Accounting address – If accounts are not accessible at the business address, you must indicate an accounting address. // Regnskabsadresse – Når virksomhedens regnskab ikke er tilgængeligt på virksomhedsadressen, skal du oplyse en regnskabsadresse.

Remote registration address – When the business is run from a remote location – i.e. address of the food cart, stand, etc. // Fjernregistreringsadresse – Når virksomheden drives fra en stadeplads – f.eks. adressen på en pølsevogn, boden mv.

Warehouse address – If there is a warehouse somewhere other than at the business address. // Lageradresse – Når der findes et lager andre steder end på virksomhedsadressen.

If you do not need to add additional addresses, click “Next” // Er der ikke behov for at tilføje yderligere adresser, skal du klikke på knappen “Næste”

Add addresses // Tilføj adresser

Now you will receive a summary of the information you have entered. Check to make sure all the information is correct, then approve and submit your application.

You will usually receive your CVR number within 24 hours, and then you are in business. Congratulations!

GET THE MINIGUIDE AS PDF:

NEED MORE KNOWLEDGE?

CAKI has published more miniguides – have a look at the publications page here.